Page 148 - Essentials of Payroll: Management and Accounting

P. 148

Compensation

chute agreement, its president, Jason Fleece, is awarded a payment of

$500,000. His average pay for the past five years was $125,000. Three

times this amount, or $375,000, is the limit above which a 20 percent

excise tax will be imposed. The amount subject to this tax is $125,000,

so the company must deduct $25,000 from the total payment, in addi-

tion to all normal payroll taxes on the full $500,000 paid.

Life Insurance

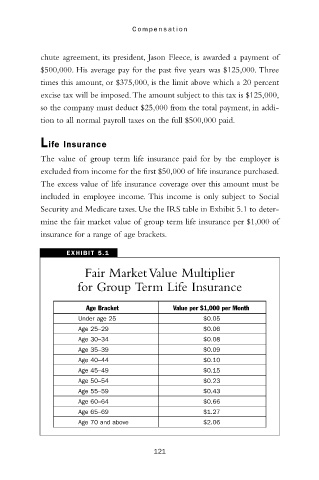

The value of group term life insurance paid for by the employer is

excluded from income for the first $50,000 of life insurance purchased.

The excess value of life insurance coverage over this amount must be

included in employee income. This income is only subject to Social

Security and Medicare taxes. Use the IRS table in Exhibit 5.1 to deter-

mine the fair market value of group term life insurance per $1,000 of

insurance for a range of age brackets.

EXHIBIT 5.1

Fair Market Value Multiplier

for Group Term Life Insurance

Age Bracket Value per $1,000 per Month

Under age 25 $0.05

Age 25–29 $0.06

Age 30–34 $0.08

Age 35–39 $0.09

Age 40–44 $0.10

Age 45–49 $0.15

Age 50–54 $0.23

Age 55–59 $0.43

Age 60–64 $0.66

Age 65–69 $1.27

Age 70 and above $2.06

121