Page 160 - Essentials of Payroll: Management and Accounting

P. 160

Compensation

As with the W-2 form, this form must be issued to suppliers as well

as to the IRS, no later than January 31 of the year following the report-

ing year.

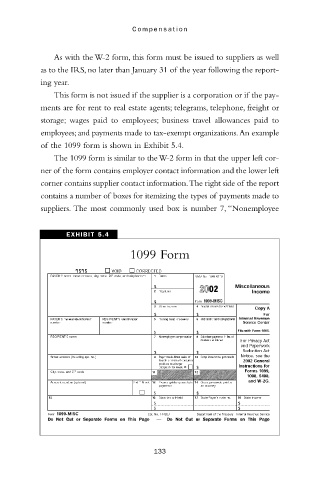

This form is not issued if the supplier is a corporation or if the pay-

ments are for rent to real estate agents; telegrams, telephone, freight or

storage; wages paid to employees; business travel allowances paid to

employees;and payments made to tax-exempt organizations.An example

of the 1099 form is shown in Exhibit 5.4.

The 1099 form is similar to the W-2 form in that the upper left cor-

ner of the form contains employer contact information and the lower left

corner contains supplier contact information.The right side of the report

contains a number of boxes for itemizing the types of payments made to

suppliers. The most commonly used box is number 7, “Nonemployee

EXHIBIT 5.4

1099 Form

133