Page 220 - Essentials of Payroll: Management and Accounting

P. 220

Payr oll Taxes and Remittances

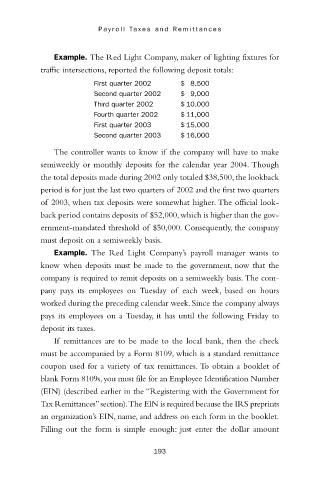

Example. The Red Light Company, maker of lighting fixtures for

traffic intersections, reported the following deposit totals:

First quarter 2002 $ 8,500

Second quarter 2002 $ 9,000

Third quarter 2002 $ 10,000

Fourth quarter 2002 $ 11,000

First quarter 2003 $ 15,000

Second quarter 2003 $ 16,000

The controller wants to know if the company will have to make

semiweekly or monthly deposits for the calendar year 2004. Though

the total deposits made during 2002 only totaled $38,500, the lookback

period is for just the last two quarters of 2002 and the first two quarters

of 2003, when tax deposits were somewhat higher. The official look-

back period contains deposits of $52,000,which is higher than the gov-

ernment-mandated threshold of $50,000. Consequently, the company

must deposit on a semiweekly basis.

Example. The Red Light Company’s payroll manager wants to

know when deposits must be made to the government, now that the

company is required to remit deposits on a semiweekly basis. The com-

pany pays its employees on Tuesday of each week, based on hours

worked during the preceding calendar week. Since the company always

pays its employees on a Tuesday, it has until the following Friday to

deposit its taxes.

If remittances are to be made to the local bank, then the check

must be accompanied by a Form 8109, which is a standard remittance

coupon used for a variety of tax remittances. To obtain a booklet of

blank Form 8109s, you must file for an Employee Identification Number

(EIN) (described earlier in the “Registering with the Government for

Tax Remittances”section).The EIN is required because the IRS preprints

an organization’s EIN, name, and address on each form in the booklet.

Filling out the form is simple enough: just enter the dollar amount

193