Page 217 - Essentials of Payroll: Management and Accounting

P. 217

ESSENTIALS of Payr oll: Management and Accounting

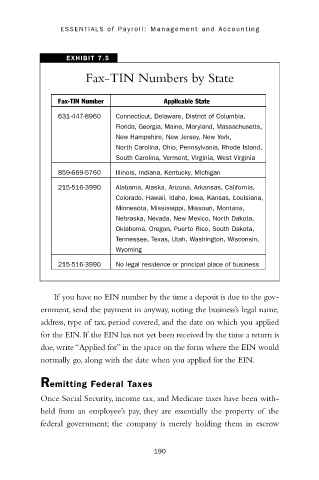

EXHIBIT 7.5

Fax-TIN Numbers by State

Fax-TIN Number Applicable State

631-447-8960 Connecticut, Delaware, District of Columbia,

Florida, Georgia, Maine, Maryland, Massachusetts,

New Hampshire, New Jersey, New York,

North Carolina, Ohio, Pennsylvania, Rhode Island,

South Carolina, Vermont, Virginia, West Virginia

859-669-5760 Illinois, Indiana, Kentucky, Michigan

215-516-3990 Alabama, Alaska, Arizona, Arkansas, California,

Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana,

Minnesota, Mississippi, Missouri, Montana,

Nebraska, Nevada, New Mexico, North Dakota,

Oklahoma, Oregon, Puerto Rico, South Dakota,

Tennessee, Texas, Utah, Washington, Wisconsin,

Wyoming

215-516-3990 No legal residence or principal place of business

If you have no EIN number by the time a deposit is due to the gov-

ernment, send the payment in anyway, noting the business’s legal name,

address, type of tax, period covered, and the date on which you applied

for the EIN. If the EIN has not yet been received by the time a return is

due, write “Applied for” in the space on the form where the EIN would

normally go, along with the date when you applied for the EIN.

Remitting Federal Taxes

Once Social Security, income tax, and Medicare taxes have been with-

held from an employee’s pay, they are essentially the property of the

federal government; the company is merely holding them in escrow

190