Page 212 - Essentials of Payroll: Management and Accounting

P. 212

Payr oll Taxes and Remittances

paperwork involved, a company that remits its own state taxes should

construct a calendar of remittances, which the payroll manager can use

to ensure that payments are always made,thereby avoiding late-payment

penalties and interest charges.

If an employer has nonresident employees, and the state in which

it does business has an income tax, the employer will usually withhold

income for each employee’s state of residence.Alternatively, an employer

can withhold income on behalf of the state in which it does business

and let the employee claim a credit on his or her state tax return to avoid

double taxation. The ability to do this will vary by individual state law.

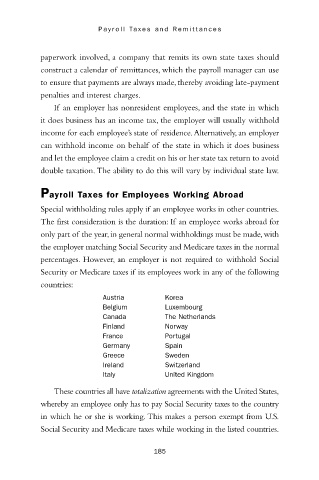

Payroll Taxes for Employees Working Abroad

Special withholding rules apply if an employee works in other countries.

The first consideration is the duration: If an employee works abroad for

only part of the year,in general normal withholdings must be made,with

the employer matching Social Security and Medicare taxes in the normal

percentages. However, an employer is not required to withhold Social

Security or Medicare taxes if its employees work in any of the following

countries:

Austria Korea

Belgium Luxembourg

Canada The Netherlands

Finland Norway

France Portugal

Germany Spain

Greece Sweden

Ireland Switzerland

Italy United Kingdom

These countries all have totalization agreements with the United States,

whereby an employee only has to pay Social Security taxes to the country

in which he or she is working. This makes a person exempt from U.S.

Social Security and Medicare taxes while working in the listed countries.

185