Page 210 - Essentials of Payroll: Management and Accounting

P. 210

Payr oll Taxes and Remittances

Social Security Taxes

Employers are required to withhold 6.2 percent of each employee’s pay,

which is forwarded to the government Social Security fund. The

employer must also match this amount, so the total remittance to the

government is 12.4 percent.This withholding applies to the first $84,900

of employee pay in each calendar year, though this number increases

regularly by act of Congress.

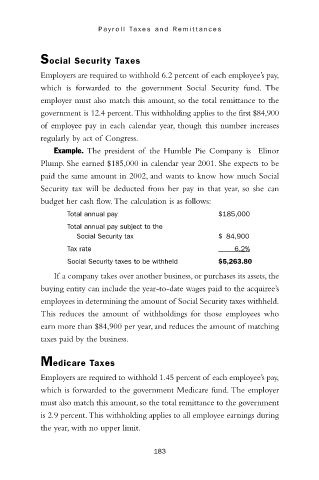

Example. The president of the Humble Pie Company is Elinor

Plump. She earned $185,000 in calendar year 2001. She expects to be

paid the same amount in 2002, and wants to know how much Social

Security tax will be deducted from her pay in that year, so she can

budget her cash flow. The calculation is as follows:

Total annual pay $185,000

Total annual pay subject to the

Social Security tax $ 84,900

Tax rate 6.2%

Social Security taxes to be withheld $5,263.80

If a company takes over another business, or purchases its assets, the

buying entity can include the year-to-date wages paid to the acquiree’s

employees in determining the amount of Social Security taxes withheld.

This reduces the amount of withholdings for those employees who

earn more than $84,900 per year, and reduces the amount of matching

taxes paid by the business.

Medicare Taxes

Employers are required to withhold 1.45 percent of each employee’s pay,

which is forwarded to the government Medicare fund. The employer

must also match this amount, so the total remittance to the government

is 2.9 percent.This withholding applies to all employee earnings during

the year, with no upper limit.

183