Page 105 - Finance for Non-Financial Managers

P. 105

Siciliano06.qxd 2/8/2003 7:05 AM Page 86

Finance for Non-Financial Managers

86

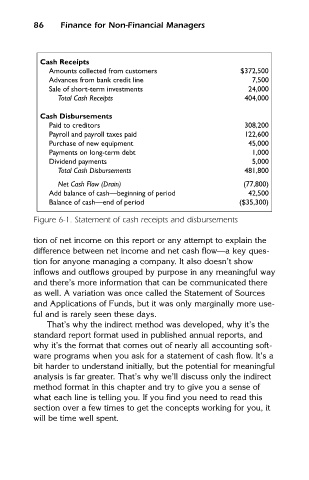

Cash Receipts

Amounts collected from customers $372,500

Advances from bank credit line 7,500

Sale of short-term investments 24,000

Total Cash Receipts 404,000

Cash Disbursements

Paid to creditors 308,200

Payroll and payroll taxes paid 122,600

Purchase of new equipment 45,000

Payments on long-term debt 1,000

Dividend payments 5,000

Total Cash Disbursements 481,800

Net Cash Flow (Drain) (77,800)

Add balance of cash—beginning of period 42,500

Balance of cash—end of period ($35,300)

Figure 6-1. Statement of cash receipts and disbursements

tion of net income on this report or any attempt to explain the

difference between net income and net cash flow—a key ques-

tion for anyone managing a company. It also doesn’t show

inflows and outflows grouped by purpose in any meaningful way

and there’s more information that can be communicated there

as well. A variation was once called the Statement of Sources

and Applications of Funds, but it was only marginally more use-

ful and is rarely seen these days.

That’s why the indirect method was developed, why it’s the

standard report format used in published annual reports, and

why it’s the format that comes out of nearly all accounting soft-

ware programs when you ask for a statement of cash flow. It’s a

bit harder to understand initially, but the potential for meaningful

analysis is far greater. That’s why we’ll discuss only the indirect

method format in this chapter and try to give you a sense of

what each line is telling you. If you find you need to read this

section over a few times to get the concepts working for you, it

will be time well spent.