Page 107 - Finance for Non-Financial Managers

P. 107

Siciliano06.qxd 2/8/2003 7:05 AM Page 88

Finance for Non-Financial Managers

88

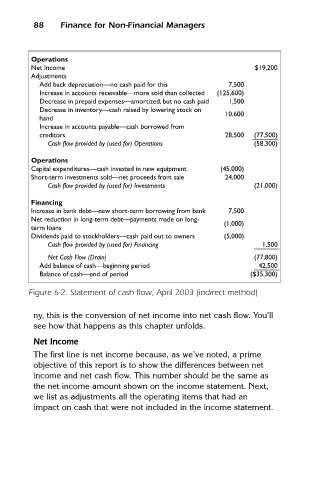

Operations

Net Income

Adjustments $19,200

Add back depreciation—no cash paid for this 7,500

Increase in accounts receivable—more sold than collected (125,600)

Decrease in prepaid expenses—amortized, but no cash paid 1,500

Decrease in inventory—cash raised by lowering stock on

10,600

hand

Increase in accounts payable—cash borrowed from

creditors 28,500 (77,500)

Cash flow provided by (used for) Operations (58,300)

Operations

Capital expenditures—cash invested in new equipment (45,000)

Short-term investments sold—net proceeds from sale 24,000

Cash flow provided by (used for) Investments (21,000)

(58,300)

Financing

Increase in bank debt—new short-term borrowing from bank 7,500

Net reduction in long-term debt—payments made on long-

(1,000)

term loans

Dividends paid to stockholders—cash paid out to owners (5,000)

Cash flow provided by (used for) Financing 1,500

Net Cash Flow (Drain) (77,800)

Add balance of cash—beginning period 42,500

Balance of cash—end of period ($35,300)

Figure 6-2. Statement of cash flow, April 2003 (indirect method)

ny, this is the conversion of net income into net cash flow. You’ll

see how that happens as this chapter unfolds.

Net Income

The first line is net income because, as we’ve noted, a prime

objective of this report is to show the differences between net

income and net cash flow. This number should be the same as

the net income amount shown on the income statement. Next,

we list as adjustments all the operating items that had an

impact on cash that were not included in the income statement.