Page 230 - Finance for Non-Financial Managers

P. 230

SicilianoIndex.qxd 2/10/2003 9:51 AM Page 211

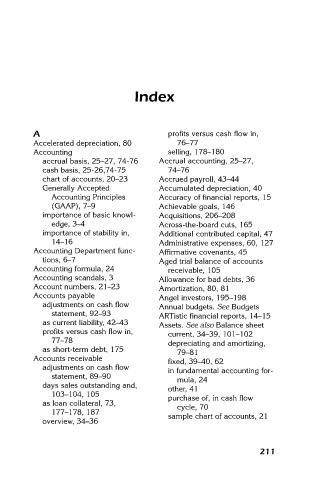

Index

A profits versus cash flow in,

Accelerated depreciation, 80 76–77

Accounting selling, 178–180

accrual basis, 25–27, 74-76 Accrual accounting, 25–27,

cash basis, 25-26,74-75 74–76

chart of accounts, 20–23 Accrued payroll, 43–44

Generally Accepted Accumulated depreciation, 40

Accounting Principles Accuracy of financial reports, 15

(GAAP), 7–9 Achievable goals, 146

importance of basic knowl- Acquisitions, 206–208

edge, 3–4 Across-the-board cuts, 165

importance of stability in, Additional contributed capital, 47

14–16 Administrative expenses, 60, 127

Accounting Department func- Affirmative covenants, 45

tions, 6–7 Aged trial balance of accounts

Accounting formula, 24 receivable, 105

Accounting scandals, 3 Allowance for bad debts, 36

Account numbers, 21–23 Amortization, 80, 81

Accounts payable Angel investors, 195–198

adjustments on cash flow Annual budgets. See Budgets

statement, 92–93 ARTistic financial reports, 14–15

as current liability, 42–43

Assets. See also Balance sheet

profits versus cash flow in, current, 34–39, 101–102

77–78

depreciating and amortizing,

as short-term debt, 175 79–81

Accounts receivable

fixed, 39–40, 62

adjustments on cash flow in fundamental accounting for-

statement, 89–90 mula, 24

days sales outstanding and,

other, 41

103–104, 105 purchase of, in cash flow

as loan collateral, 73,

cycle, 70

177–178, 187 sample chart of accounts, 21

overview, 34–36

211