Page 49 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 49

34 PART I Background and Context

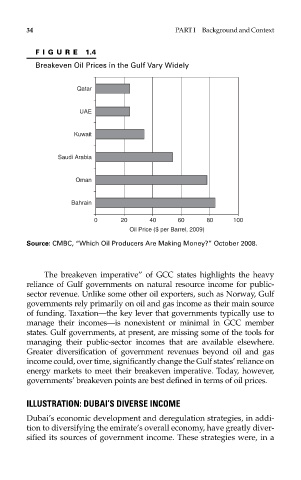

FIGURE 1.4

Breakeven Oil Prices in the Gulf Vary Widely

Qatar

UAE

Kuwait

Saudi Arabia

Oman

Bahrain

0 20 40 60 80 100

Oil Price ($ per Barrel, 2009)

Source: CMBC, “Which Oil Producers Are Making Money?” October 2008.

The breakeven imperative” of GCC states highlights the heavy

reliance of Gulf governments on natural resource income for public-

sector revenue. Unlike some other oil exporters, such as Norway, Gulf

governments rely primarily on oil and gas income as their main source

of funding. Taxation—the key lever that governments typically use to

manage their incomes—is nonexistent or minimal in GCC member

states. Gulf governments, at present, are missing some of the tools for

managing their public-sector incomes that are available elsewhere.

Greater diversification of government revenues beyond oil and gas

income could, over time, significantly change the Gulf states’ reliance on

energy markets to meet their breakeven imperative. Today, however,

governments’ breakeven points are best defined in terms of oil prices.

ILLUSTRATION: DUBAI’S DIVERSE INCOME

Dubai’s economic development and deregulation strategies, in addi-

tion to diversifying the emirate’s overall economy, have greatly diver-

sified its sources of government income. These strategies were, in a