Page 46 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 46

CHAPTER 1 Floating on Wealth 31

economic growth in the GCC has not been “all about oil”—oil has dri-

ven wealth creation, but this wealth has created booms in a wide range

of economic sectors. 23

Were the Gulf to maintain the growth rate it experienced

between 2002 and 2006, its economy would double every 11 years. By

contrast, the core OECD markets would need more than 30 years to

double in size were they to maintain their rate of expansion for the

period. In reality, of course, the healthy growth period of the early to

mid-2000s has been followed by a deep recession that has affected

economies worldwide—including those of the Gulf.

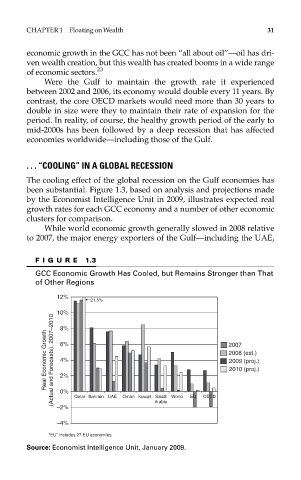

. . . “COOLING” IN A GLOBAL RECESSION

The cooling effect of the global recession on the Gulf economies has

been substantial. Figure 1.3, based on analysis and projections made

by the Economist Intelligence Unit in 2009, illustrates expected real

growth rates for each GCC economy and a number of other economic

clusters for comparison.

While world economic growth generally slowed in 2008 relative

to 2007, the major energy exporters of the Gulf—including the UAE,

FIGURE 1.3

GCC Economic Growth Has Cooled, but Remains Stronger than That

of Other Regions

12%

21.5%

10%

8%

Real Economic Growth (Actual and Forecasts), 2007–2010 6% 2007

2008 (est.)

4%

2009 (proj.)

2010 (proj.)

2%

0%

Saudi

–2% Qatar Bahrain UAE Oman Kuwait Arabia World EU OECD

–4%

“EU” includes 27 EU economies.

Source: Economist Intelligence Unit, January 2009.