Page 43 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 43

28 PART I Background and Context

HEALTHY SURPLUSES

The large reserves that the Gulf enjoys today have been enabled by

healthy budget surpluses over the past decades. Surpluses have var-

ied greatly from year to year based on the market price of oil, and

some years have seen deficits. In fact, Saudi Arabia—the core economy

of the region—expects a deficit in 2009 as a result of an expansionary

budget designed to stimulate the local economy. 18 Nonetheless, siz-

able surpluses have been the norm in the wealthier Gulf states, espe-

cially in recent years.

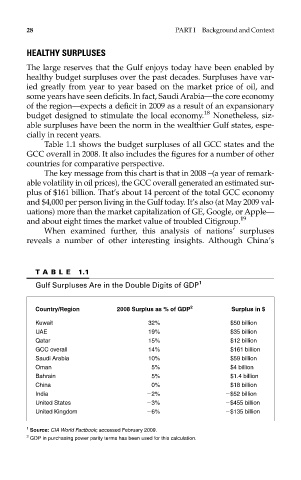

Table 1.1 shows the budget surpluses of all GCC states and the

GCC overall in 2008. It also includes the figures for a number of other

countries for comparative perspective.

The key message from this chart is that in 2008 –(a year of remark-

able volatility in oil prices), the GCC overall generated an estimated sur-

plus of $161 billion. That’s about 14 percent of the total GCC economy

and $4,000 per person living in the Gulf today. It’s also (at May 2009 val-

uations) more than the market capitalization of GE, Google, or Apple—

and about eight times the market value of troubled Citigroup. 19

When examined further, this analysis of nations’ surpluses

reveals a number of other interesting insights. Although China’s

T ABLE 1.1

Gulf Surpluses Are in the Double Digits of GDP 1

Country/Region 2008 Surplus as % of GDP 2 Surplus in $

Kuwait 32% $50 billion

UAE 19% $35 billion

Qatar 15% $12 billion

GCC overall 14% $161 billion

Saudi Arabia 10% $59 billion

Oman 5% $4 billion

Bahrain 5% $1.4 billion

China 0% $18 billion

India 2% $52 billion

United States 3% $455 billion

United Kingdom 6% $135 billion

1

Source: CIA World Factbook; accessed February 2009.

2

GDP in purchasing power parity terms has been used for this calculation.