Page 42 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 42

CHAPTER 1 Floating on Wealth 27

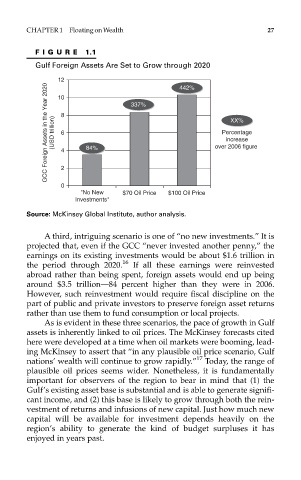

FIGURE 1.1

Gulf Foreign Assets Are Set to Grow through 2020

12 337% 442%

GCC Foreign Assets in the Year 2020 (USD trillion) 8 6 4 84% over 2006 figure

10

XX%

Percentage

increase

0 2

"No New $70 Oil Price $100 Oil Price

Investments"

Source: McKinsey Global Institute, author analysis.

A third, intriguing scenario is one of “no new investments.” It is

projected that, even if the GCC “never invested another penny,” the

earnings on its existing investments would be about $1.6 trillion in

the period through 2020. 16 If all these earnings were reinvested

abroad rather than being spent, foreign assets would end up being

around $3.5 trillion—84 percent higher than they were in 2006.

However, such reinvestment would require fiscal discipline on the

part of public and private investors to preserve foreign asset returns

rather than use them to fund consumption or local projects.

As is evident in these three scenarios, the pace of growth in Gulf

assets is inherently linked to oil prices. The McKinsey forecasts cited

here were developed at a time when oil markets were booming, lead-

ing McKinsey to assert that “in any plausible oil price scenario, Gulf

nations’ wealth will continue to grow rapidly.” 17 Today, the range of

plausible oil prices seems wider. Nonetheless, it is fundamentally

important for observers of the region to bear in mind that (1) the

Gulf’s existing asset base is substantial and is able to generate signifi-

cant income, and (2) this base is likely to grow through both the rein-

vestment of returns and infusions of new capital. Just how much new

capital will be available for investment depends heavily on the

region’s ability to generate the kind of budget surpluses it has

enjoyed in years past.