Page 85 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 85

CHAPTER 2 Entrusted Stewards 69

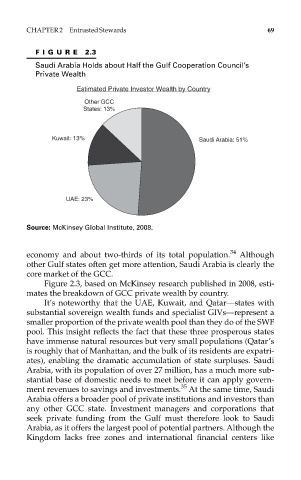

FIGURE 2.3

Saudi Arabia Holds about Half the Gulf Cooperation Council’s

Private Wealth

Estimated Private Investor Wealth by Country

Other GCC

States: 13%

Kuwait: 13% Saudi Arabia: 51%

UAE: 23%

Source: McKinsey Global Institute, 2008.

economy and about two-thirds of its total population. 34 Although

other Gulf states often get more attention, Saudi Arabia is clearly the

core market of the GCC.

Figure 2.3, based on McKinsey research published in 2008, esti-

mates the breakdown of GCC private wealth by country.

It’s noteworthy that the UAE, Kuwait, and Qatar—states with

substantial sovereign wealth funds and specialist GIVs—represent a

smaller proportion of the private wealth pool than they do of the SWF

pool. This insight reflects the fact that these three prosperous states

have immense natural resources but very small populations (Qatar’s

is roughly that of Manhattan, and the bulk of its residents are expatri-

ates), enabling the dramatic accumulation of state surpluses. Saudi

Arabia, with its population of over 27 million, has a much more sub-

stantial base of domestic needs to meet before it can apply govern-

35

ment revenues to savings and investments. At the same time, Saudi

Arabia offers a broader pool of private institutions and investors than

any other GCC state. Investment managers and corporations that

seek private funding from the Gulf must therefore look to Saudi

Arabia, as it offers the largest pool of potential partners. Although the

Kingdom lacks free zones and international financial centers like