Page 116 -

P. 116

98 CHAPTER 4 The Procurement Process

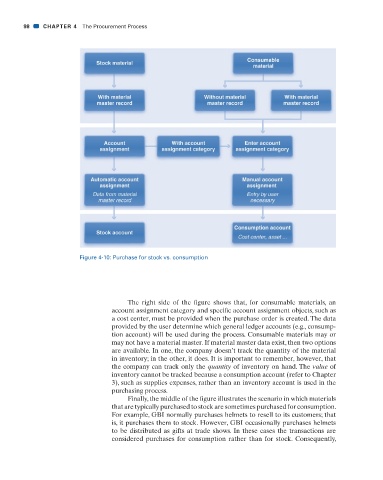

Figure 4-10: Purchase for stock vs. consumption

The right side of the fi gure shows that, for consumable materials, an

account assignment category and specifi c account assignment objects, such as

a cost center, must be provided when the purchase order is created. The data

provided by the user determine which general ledger accounts (e.g., consump-

tion account) will be used during the process. Consumable materials may or

may not have a material master. If material master data exist, then two options

are available. In one, the company doesn’t track the quantity of the material

in inventory; in the other, it does. It is important to remember, however, that

the company can track only the quantity of inventory on hand. The value of

inventory cannot be tracked because a consumption account (refer to Chapter

3), such as supplies expenses, rather than an inventory account is used in the

purchasing process.

Finally, the middle of the fi gure illustrates the scenario in which materials

that are typically purchased to stock are sometimes purchased for consumption.

For example, GBI normally purchases helmets to resell to its customers; that

is, it purchases them to stock. However, GBI occasionally purchases helmets

to be distributed as gifts at trade shows. In these cases the transactions are

considered purchases for consumption rather than for stock. Consequently,

31/01/11 7:35 PM

CH004.indd 98

CH004.indd 98 31/01/11 7:35 PM