Page 80 -

P. 80

62 CHAPTER 3 Introduction to Accounting

Consider another example. GBI purchases offi ce supplies for $500 with

a check. Offi ce supplies are expensed; that is, they are defi ned as money

spent rather than treated as an asset upon purchase, even if some of the sup-

plies remain unused. In this case, the relevant accounts are bank and supplies

expense. This posting is diagrammed in Figure 3-13.

Figure 3-13: Posting example 2: Purchase of supplies

with cash

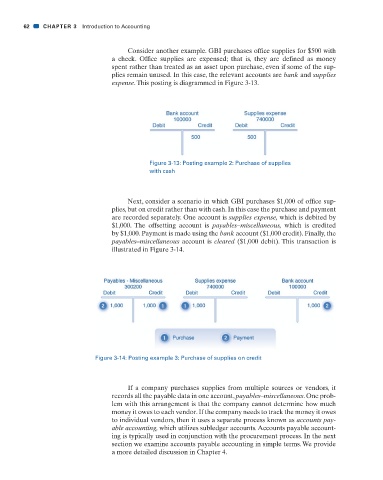

Next, consider a scenario in which GBI purchases $1,000 of offi ce sup-

plies, but on credit rather than with cash. In this case the purchase and payment

are recorded separately. One account is supplies expense, which is debited by

$1,000. The offsetting account is payables–miscellaneous, which is credited

by $1,000. Payment is made using the bank account ($1,000 credit). Finally, the

payables–miscellaneous account is cleared ($1,000 debit). This transaction is

illustrated in Figure 3-14.

Figure 3-14: Posting example 3: Purchase of supplies on credit

If a company purchases supplies from multiple sources or vendors, it

records all the payable data in one account, payables–miscellaneous. One prob-

lem with this arrangement is that the company cannot determine how much

money it owes to each vendor. If the company needs to track the money it owes

to individual vendors, then it uses a separate process known as accounts pay-

able accounting, which utilizes subledger accounts. Accounts payable account-

ing is typically used in conjunction with the procurement process. In the next

section we examine accounts payable accounting in simple terms. We provide

a more detailed discussion in Chapter 4.

31/01/11 1:09 PM

CH003.indd 62 31/01/11 1:09 PM

CH003.indd 62