Page 85 -

P. 85

Processes 67

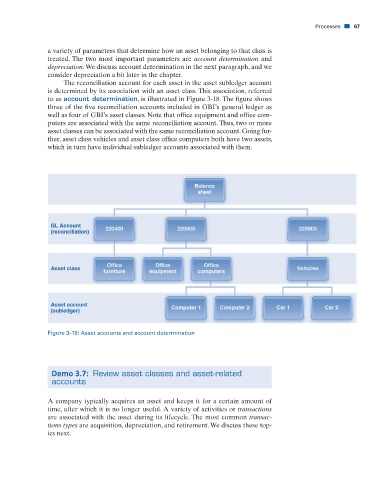

a variety of parameters that determine how an asset belonging to that class is

treated. The two most important parameters are account determination and

depreciation. We discuss account determination in the next paragraph, and we

consider depreciation a bit later in the chapter.

The reconciliation account for each asset in the asset subledger account

is determined by its association with an asset class. This association, referred

to as account determination, is illustrated in Figure 3-18. The fi gure shows

three of the fi ve reconciliation accounts included in GBI’s general ledger as

well as four of GBI’s asset classes. Note that offi ce equipment and offi ce com-

puters are associated with the same reconciliation account. Thus, two or more

asset classes can be associated with the same reconciliation account. Going fur-

ther, asset class vehicles and asset class offi ce computers both have two assets,

which in turn have individual subledger accounts associated with them.

GL Account

Figure 3-18: Asset accounts and account determination

Demo 3.7: Review asset classes and asset-related

accounts

A company typically acquires an asset and keeps it for a certain amount of

time, after which it is no longer useful. A variety of activities or transactions

are associated with the asset during its lifecycle. The most common transac-

tions types are acquisition, depreciation, and retirement. We discuss these top-

ics next.

31/01/11 1:09 PM

CH003.indd 67 31/01/11 1:09 PM

CH003.indd 67