Page 88 -

P. 88

70 CHAPTER 3 Introduction to Accounting

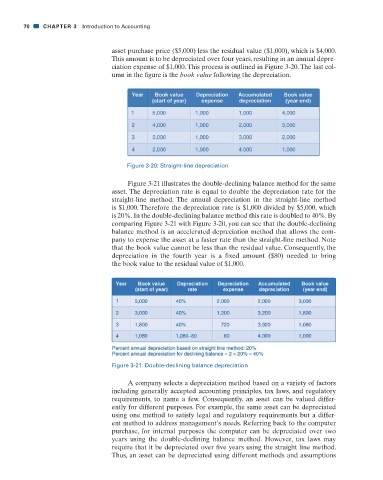

asset purchase price ($5,000) less the residual value ($1,000), which is $4,000.

This amount is to be depreciated over four years, resulting in an annual depre-

ciation expense of $1,000. This process is outlined in Figure 3-20. The last col-

umn in the fi gure is the book value following the depreciation.

Figure 3-20: Straight-line depreciation

Figure 3-21 illustrates the double-declining balance method for the same

asset. The depreciation rate is equal to double the depreciation rate for the

straight-line method. The annual depreciation in the straight-line method

is $1,000. Therefore the depreciation rate is $1,000 divided by $5,000, which

is 20%. In the double-declining balance method this rate is doubled to 40%. By

comparing Figure 3-21 with Figure 3-20, you can see that the double-declining

balance method is an accelerated depreciation method that allows the com-

pany to expense the asset at a faster rate than the straight-line method. Note

that the book value cannot be less than the residual value. Consequently, the

depreciation in the fourth year is a fi xed amount ($80) needed to bring

the book value to the residual value of $1,000.

1,080–80

Figure 3-21: Double-declining balance depreciation

A company selects a depreciation method based on a variety of factors

including generally accepted accounting principles, tax laws, and regulatory

requirements, to name a few. Consequently, an asset can be valued differ-

ently for different purposes. For example, the same asset can be depreciated

using one method to satisfy legal and regulatory requirements but a differ-

ent method to address management’s needs. Referring back to the computer

purchase, for internal purposes the computer can be depreciated over two

years using the double-declining balance method. However, tax laws may

require that it be depreciated over fi ve years using the straight line method.

Thus, an asset can be depreciated using different methods and assumptions

31/01/11 1:09 PM

CH003.indd 70

CH003.indd 70 31/01/11 1:09 PM