Page 37 - Mobile Data Loss

P. 37

Ensuring Mobile Compliance 31

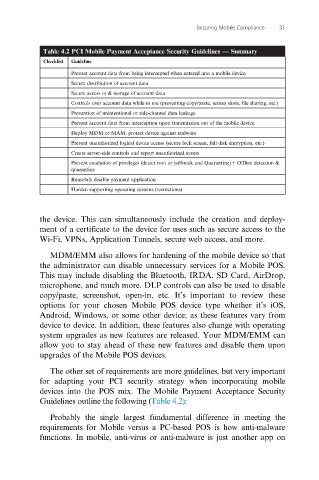

Table 4.2 PCI Mobile Payment Acceptance Security Guidelines — Summary

Checklist Guideline

Prevent account data from being intercepted when entered into a mobile device

Secure distribution of account data

Secure access to & storage of account data

Controls over account data while in use (preventing copy/paste, screen shots, file sharing, etc.)

Prevention of unintentional or side-channel data leakage

Prevent account data from interception upon transmission out of the mobile device.

Deploy MDM or MAM, protect device against malware

Prevent unauthorized logical device access (secure lock screen, full disk encryption, etc.)

Create server-side controls and report unauthorized access

Prevent escalation of privileges (detect root or jailbreak and Quarantine)1 Offline detection &

quarantine

Remotely disable payment application

Harden supporting operating systems (restrictions)

the device. This can simultaneously include the creation and deploy-

ment of a certificate to the device for uses such as secure access to the

Wi-Fi, VPNs, Application Tunnels, secure web access, and more.

MDM/EMM also allows for hardening of the mobile device so that

the administrator can disable unnecessary services for a Mobile POS.

This may include disabling the Bluetooth, IRDA, SD Card, AirDrop,

microphone, and much more. DLP controls can also be used to disable

copy/paste, screenshot, open-in, etc. It’s important to review these

options for your chosen Mobile POS device type whether it’s iOS,

Android, Windows, or some other device; as these features vary from

device to device. In addition, these features also change with operating

system upgrades as new features are released. Your MDM/EMM can

allow you to stay ahead of these new features and disable them upon

upgrades of the Mobile POS devices.

The other set of requirements are more guidelines, but very important

for adapting your PCI security strategy when incorporating mobile

devices into the POS mix. The Mobile Payment Acceptance Security

Guidelines outline the following (Table 4.2):

Probably the single largest fundamental difference in meeting the

requirements for Mobile versus a PC-based POS is how anti-malware

functions. In mobile, anti-virus or anti-malware is just another app on