Page 171 - Plant design and economics for chemical engineers

P. 171

COST AND ASSET ACCOUNTING 145

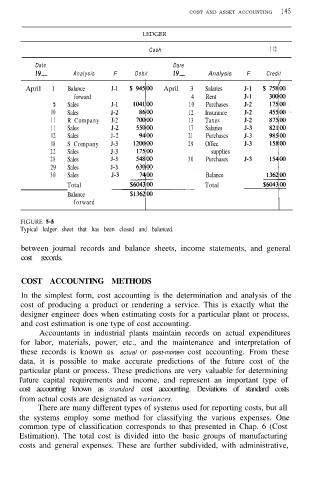

LEDGER

Cash 112

Date Dare

19- Analysis F Debit 19- Analysis F Credit

I I

April 1 Balance J-l April 3 Salaries

forward 4 Rent

5 Sales J-l 10 Purchases

10 Sales 5-2 12 Insurance

1 1 R Company J-2 13 Taxes

1 1 Sales 5-2 17 Salaries

12 Sales J-2 21 Purchases

18 S Company 3-3 29 Office

22 Sales 5-3 supplies

28 Sales 3-3 30 Purchases

29 Sales 5-3

30 Sales Balance

Total Total

Balance

forward

FIGURE 5-5

Typical ledger sheet that has been closed and balanced.

between journal records and balance sheets, income statements, and general

cost records.

COST ACCOUNTING METHODS

In the simplest form, cost accounting is the determination and analysis of the

cost of producing a product or rendering a service. This is exactly what the

designer engineer does when estimating costs for a particular plant or process,

and cost estimation is one type of cost accounting.

Accountants in industrial plants maintain records on actual expenditures

for labor, materials, power, etc., and the maintenance and interpretation of

these records is known as actual or post-mortem cost accounting. From these

data, it is possible to make accurate predictions of the future cost of the

particular plant or process. These predictions are very valuable for determining

future capital requirements and income, and represent an important type of

cost accounting known as standard cost accounting. Deviations of standard costs

from actual costs are designated as variances.

There are many different types of systems used for reporting costs, but all

the systems employ some method for classifying the various expenses. One

common type of classification corresponds to that presented in Chap. 6 (Cost

Estimation). The total cost is divided into the basic groups of manufacturing

costs and general expenses. These are further subdivided, with administrative,