Page 17 - How China Is Winning the Tech Race

P. 17

building successful enterprises, observes Kyung Yoon, vice chairman of the

3

recruiting firm Heidrick & Struggles. But there’s no shortage of technical

talent on the Mainland. As many as 644,000 engineers—three times more

4

than in the United States —graduate annually from Chinese universities.

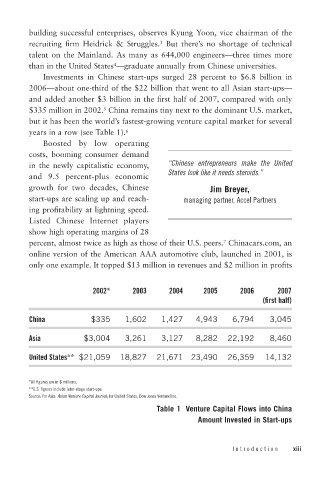

Investments in Chinese start-ups surged 28 percent to $6.8 billion in

2006—about one-third of the $22 billion that went to all Asian start-ups—

and added another $3 billion in the first half of 2007, compared with only

5

$335 million in 2002. China remains tiny next to the dominant U.S. market,

but it has been the world’s fastest-growing venture capital market for several

years in a row (see Table 1). 6

Boosted by low operating

costs, booming consumer demand

in the newly capitalistic economy, “Chinese entrepreneurs make the United

States look like it needs steroids.”

and 9.5 percent-plus economic

growth for two decades, Chinese Jim Breyer,

start-ups are scaling up and reach- managing partner, Accel Partners

ing profitability at lightning speed.

Listed Chinese Internet players

show high operating margins of 28

7

percent, almost twice as high as those of their U.S. peers. Chinacars.com, an

online version of the American AAA automotive club, launched in 2001, is

only one example. It topped $13 million in revenues and $2 million in profits

2002* 2003 2004 2005 2006 2007

(first half)

China $335 1,602 1,427 4,943 6,794 3,045

Asia $3,004 3,261 3,127 8,282 22,192 8,460

United States** $21,059 18,827 21,671 23,490 26,359 14,132

*All figures are in $ millions.

**U.S. figures include later-stage start-ups.

Source: For Asia: Asian Venture Capital Journal; for United States, Dow Jones VentureOne.

Table 1 Venture Capital Flows into China

Amount Invested in Start-ups

Introduction xiii