Page 199 -

P. 199

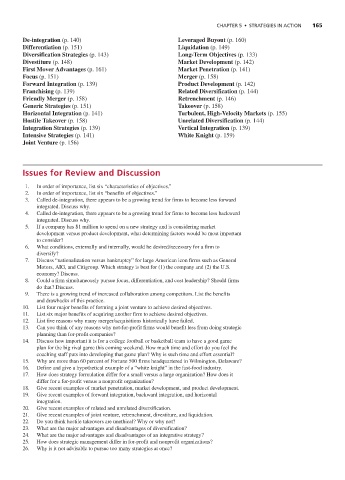

CHAPTER 5 • STRATEGIES IN ACTION 165

De-integration (p. 140) Leveraged Buyout (p. 160)

Differentiation (p. 151) Liquidation (p. 149)

Diversification Strategies (p. 143) Long-Term Objectives (p. 133)

Divestiture (p. 148) Market Development (p. 142)

First Mover Advantages (p. 161) Market Penetration (p. 141)

Focus (p. 151) Merger (p. 158)

Forward Integration (p. 139) Product Development (p. 142)

Franchising (p. 139) Related Diversification (p. 144)

Friendly Merger (p. 158) Retrenchment (p. 146)

Generic Strategies (p. 151) Takeover (p. 158)

Horizontal Integration (p. 141) Turbulent, High-Velocity Markets (p. 155)

Hostile Takeover (p. 158) Unrelated Diversification (p. 144)

Integration Strategies (p. 139) Vertical Integration (p. 139)

Intensive Strategies (p. 141) White Knight (p. 159)

Joint Venture (p. 156)

Issues for Review and Discussion

1. In order of importance, list six “characteristics of objectives.”

2. In order of importance, list six “benefits of objectives.”

3. Called de-integration, there appears to be a growing trend for firms to become less forward

integrated. Discuss why.

4. Called de-integration, there appears to be a growing trend for firms to become less backward

integrated. Discuss why.

5. If a company has $1 million to spend on a new strategy and is considering market

development versus product development, what determining factors would be most important

to consider?

6. What conditions, externally and internally, would be desired/necessary for a firm to

diversify?

7. Discuss “nationalization versus bankruptcy” for large American icon firms such as General

Motors, AIG, and Citigroup. Which strategy is best for (1) the company and (2) the U.S.

economy? Discuss.

8. Could a firm simultaneously pursue focus, differentiation, and cost leadership? Should firms

do that? Discuss.

9. There is a growing trend of increased collaboration among competitors. List the benefits

and drawbacks of this practice.

10. List four major benefits of forming a joint venture to achieve desired objectives.

11. List six major benefits of acquiring another firm to achieve desired objectives.

12. List five reasons why many merger/acquisitions historically have failed.

13. Can you think of any reasons why not-for-profit firms would benefit less from doing strategic

planning than for-profit companies?

14. Discuss how important it is for a college football or basketball team to have a good game

plan for the big rival game this coming weekend. How much time and effort do you feel the

coaching staff puts into developing that game plan? Why is such time and effort essential?

15. Why are more than 60 percent of Fortune 500 firms headquartered in Wilmington, Delaware?

16. Define and give a hypothetical example of a “white knight” in the fast-food industry.

17. How does strategy formulation differ for a small versus a large organization? How does it

differ for a for-profit versus a nonprofit organization?

18. Give recent examples of market penetration, market development, and product development.

19. Give recent examples of forward integration, backward integration, and horizontal

integration.

20. Give recent examples of related and unrelated diversification.

21. Give recent examples of joint venture, retrenchment, divestiture, and liquidation.

22. Do you think hostile takeovers are unethical? Why or why not?

23. What are the major advantages and disadvantages of diversification?

24. What are the major advantages and disadvantages of an integrative strategy?

25. How does strategic management differ in for-profit and nonprofit organizations?

26. Why is it not advisable to pursue too many strategies at once?