Page 140 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 140

126 The Complete Guide to Executive Compensation

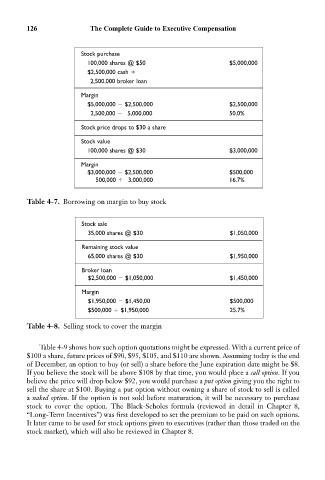

Stock purchase

100,000 shares @ $50 $5,000,000

$2,500,000 cash

2,500,000 broker loan

Margin

$5,000,000 $2,500,000 $2,500,000

2,500,000 5,000,000 50.0%

Stock price drops to $30 a share

Stock value

100,000 shares @ $30 $3,000,000

Margin

$3,000,000 $2,500,000 $500,000

500,000 3,000,000 16.7%

Table 4-7. Borrowing on margin to buy stock

Stock sale

35,000 shares @ $30 $1,050,000

Remaining stock value

65,000 shares @ $30 $1,950,000

Broker loan

$2,500,000 $1,050,000 $1,450,000

Margin

$1,950,000 $1,450,00 $500,000

$500,000 $1,950,000 25.7%

Table 4-8. Selling stock to cover the margin

Table 4-9 shows how such option quotations might be expressed. With a current price of

$100 a share, future prices of $90, $95, $105, and $110 are shown. Assuming today is the end

of December, an option to buy (or sell) a share before the June expiration date might be $8.

If you believe the stock will be above $108 by that time, you would place a call option. If you

believe the price will drop below $92, you would purchase a put option giving you the right to

sell the share at $100. Buying a put option without owning a share of stock to sell is called

a naked option. If the option is not sold before maturation, it will be necessary to purchase

stock to cover the option. The Black-Scholes formula (reviewed in detail in Chapter 8,

“Long-Term Incentives”) was first developed to set the premium to be paid on such options.

It later came to be used for stock options given to executives (rather than those traded on the

stock market), which will also be reviewed in Chapter 8.