Page 350 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 350

336 The Complete Guide to Executive Compensation

Add-on Plans. An add-on plan provides benefits in addition to those provided by the quali-

fied retirement plan. Unlike restoration plans, which apply to all affected, top-hat or add-on

plans are designed to address specific issues. This may be to adequately compensate an exec-

utive who is joining the company midcareer, leaving behind the opportunity to have final pay

multiplied by 30 or more years of service. This could be accomplished through either a fixed

formula (e.g., double the number of years of service) or crediting the years of service with pre-

vious employers. See the earlier discussion on career change impact. In other situations, it may

be to motivate an executive to leave because of faltering performance and/or a superstar

replacement in the lineup; perhaps providing a full rather than 50 percent benefit to surviving

spouse, eliminating the discount for early retirement, and/or increasing the benefit formula

(e.g., 3 percent rather than the plan formula of 1.5 percent).

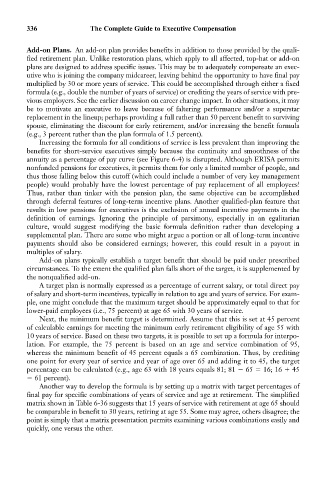

Increasing the formula for all conditions of service is less prevalent than improving the

benefits for short-service executives simply because the continuity and smoothness of the

annuity as a percentage of pay curve (see Figure 6-4) is disrupted. Although ERISA permits

nonfunded pensions for executives, it permits them for only a limited number of people, and

thus those falling below this cutoff (which could include a number of very key management

people) would probably have the lowest percentage of pay replacement of all employees!

Thus, rather than tinker with the pension plan, the same objective can be accomplished

through deferral features of long-term incentive plans. Another qualified-plan feature that

results in low pensions for executives is the exclusion of annual incentive payments in the

definition of earnings. Ignoring the principle of parsimony, especially in an egalitarian

culture, would suggest modifying the basic formula definition rather than developing a

supplemental plan. There are some who might argue a portion or all of long-term incentive

payments should also be considered earnings; however, this could result in a payout in

multiples of salary.

Add-on plans typically establish a target benefit that should be paid under prescribed

circumstances. To the extent the qualified plan falls short of the target, it is supplemented by

the nonqualified add-on.

A target plan is normally expressed as a percentage of current salary, or total direct pay

of salary and short-term incentives, typically in relation to age and years of service. For exam-

ple, one might conclude that the maximum target should be approximately equal to that for

lower-paid employees (i.e., 75 percent) at age 65 with 30 years of service.

Next, the minimum benefit target is determined. Assume that this is set at 45 percent

of calculable earnings for meeting the minimum early retirement eligibility of age 55 with

10 years of service. Based on these two targets, it is possible to set up a formula for interpo-

lation. For example, the 75 percent is based on an age and service combination of 95,

whereas the minimum benefit of 45 percent equals a 65 combination. Thus, by crediting

one point for every year of service and year of age over 65 and adding it to 45, the target

percentage can be calculated (e.g., age 63 with 18 years equals 81; 81 65 16; 16 45

61 percent).

Another way to develop the formula is by setting up a matrix with target percentages of

final pay for specific combinations of years of service and age at retirement. The simplified

matrix shown in Table 6-36 suggests that 15 years of service with retirement at age 65 should

be comparable in benefit to 30 years, retiring at age 55. Some may agree, others disagree; the

point is simply that a matrix presentation permits examining various combinations easily and

quickly, one versus the other.