Page 476 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 476

462 The Complete Guide to Executive Compensation

Stock Price. The underlying stock price is determined in any one of the previously

described methods for stock options.

Number of Shares. Normally, the number of SARs is equal to the number of shares under

option; however, one variation would be to attach SARs to only half the stock options and

require that a stock option be exercised with every SAR. Plans may allow for issuance only at

time of option grant or any time during the life of an outstanding option. The SAR may be

eligible for the full market gain over the option price or artificially limited (e.g., no more than

a 25 percent increase); this will minimize the exercise of SARs when larger gains are attain-

able by exercising the accompanying option. The settlement in some plans permits only

stock, whereas others allow a combination of stock and/or cash settlements. Some plans

provide for a supplementary cash payment to cover the estimated tax liability; such provisions

are more logical when settlement is in stock, as the executive will not be forced to sell stock

in order to meet tax obligations. This could be accomplished by giving a SAR payable in cash

in addition to stock received in exercising the option.

Exercising the SAR. Table 8-42 illustrates a typical SAR in tandem with a stock option,

namely, the exercise of one cancels the other. Assume the executive was granted an option

of 1,000 shares at $100 a share with SARs attached to all shares. Several years later the

stock is selling at $160, and the executive, rather than seek financing, wishes to exercise the

1,000 shares as appreciation rights. The 1,000 shares have an aggregate option price of

$100,000 and a fair market value of $160,000. The $60,000 difference divided by the

market price of $160 a share would mean the executive would receive 375 shares of

stock worth $60,0000 or any combination of stock and cash totaling $60,000 (if permitted by

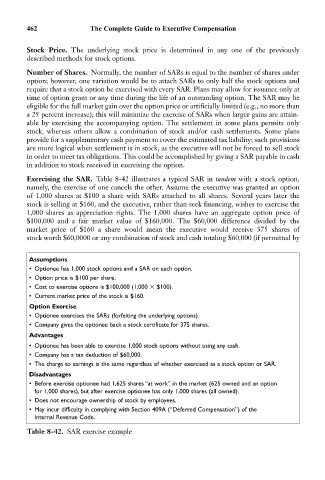

Assumptions

• Optionee has 1,000 stock options and a SAR on each option.

• Option price is $100 per share.

• Cost to exercise options is $100,000 (1,000 $100).

• Current market price of the stock is $160.

Option Exercise

• Optionee exercises the SARs (forfeiting the underlying options).

• Company gives the optionee back a stock certificate for 375 shares.

Advantages

• Optionee has been able to exercise 1,000 stock options without using any cash.

• Company has a tax deduction of $60,000.

• The charge to earnings is the same regardless of whether exercised as a stock option or SAR.

Disadvantages

• Before exercise optionee had 1,625 shares “at work” in the market (625 owned and an option

for 1,000 shares), but after exercise optionee has only 1,000 shares (all owned).

• Does not encourage ownership of stock by employees.

• May incur difficulty in complying with Section 409A (“Deferred Compensation”) of the

Internal Revenue Code.

Table 8-42. SAR exercise example