Page 478 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 478

464 The Complete Guide to Executive Compensation

The popularity of SARs waned with the spread of stock-for-stock and cashless exercises

of stock options, since the executive ended up with the same number of shares (or cash equiv-

alent) that would have been received through exercise of the SARs as illustrated earlier.

While all three transactions bring a tax deduction to the company, the SAR resulted in a

charge to corporate earnings, whereas the stock-for-stock exchange and cashless exercise did

not. But SARs became more popular when FAS 123R put them and stock options on equal

terms for a charge to the earnings statement. They are also used when the country in which

the optionee resides imposes onerous taxes (typically at time of grant) and/or prohibits hold-

ing the security of a foreign country (or perhaps using foreign currency to purchase those

shares) and also when there is a change of control of the company (see Chapter 6’s discussion

on employment agreements). A typical clause would be 100 percent vesting and automatic

payout of the stock option appreciation in the form of SARs.

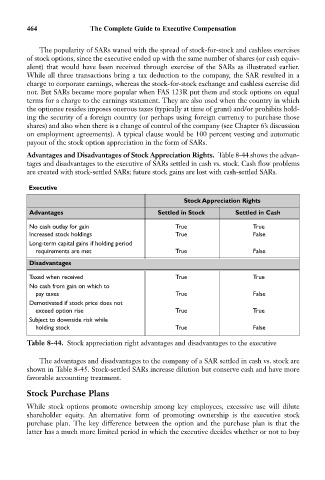

Advantages and Disadvantages of Stock Appreciation Rights. Table 8-44 shows the advan-

tages and disadvantages to the executive of SARs settled in cash vs. stock. Cash flow problems

are created with stock-settled SARs; future stock gains are lost with cash-settled SARs.

Executive

Stock Appreciation Rights

Advantages Settled in Stock Settled in Cash

No cash outlay for gain True True

Increased stock holdings True False

Long-term capital gains if holding period

requirements are met True False

Disadvantages

Taxed when received True True

No cash from gain on which to

pay taxes True False

Demotivated if stock price does not

exceed option rise True True

Subject to downside risk while

holding stock True False

Table 8-44. Stock appreciation right advantages and disadvantages to the executive

The advantages and disadvantages to the company of a SAR settled in cash vs. stock are

shown in Table 8-45. Stock-settled SARs increase dilution but conserve cash and have more

favorable accounting treatment.

Stock Purchase Plans

While stock options promote ownership among key employees, excessive use will dilute

shareholder equity. An alternative form of promoting ownership is the executive stock

purchase plan. The key difference between the option and the purchase plan is that the

latter has a much more limited period in which the executive decides whether or not to buy