Page 483 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 483

Chapter 8. Long-Term Incentives 469

but the cost basis for selling the class A common stock remains at $90. Assuming it was sold

two years later when the stock was at $130, there would be a long-term capital gains tax on

the $40 (i.e., $130 $90).

The advantage to the executive is long-term capital gains tax treatment on the apprecia-

tion in class A common stock over the fair value of the class B stock at time of purchase.

However, the company incurs a charge to earnings for the difference between the fair

market value of the class A common stock (at the date of the grant) and the purchase price of

the junior stock but only a tax deduction for the ordinary income segment. Furthermore, the

junior stock will be considered as shares outstanding for the purpose of determining earnings

per share.

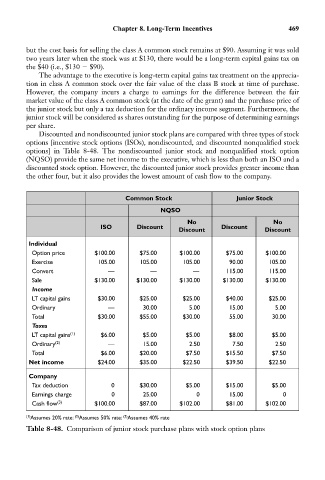

Discounted and nondiscounted junior stock plans are compared with three types of stock

options [incentive stock options (ISOs), nondiscounted, and discounted nonqualified stock

options] in Table 8-48. The nondiscounted junior stock and nonqualified stock option

(NQSO) provide the same net income to the executive, which is less than both an ISO and a

discounted stock option. However, the discounted junior stock provides greater income than

the other four, but it also provides the lowest amount of cash flow to the company.

Common Stock Junior Stock

NQSO

No No

ISO Discount Discount

Discount Discount

Individual

Option price $100.00 $75.00 $100.00 $75.00 $100.00

Exercise 105.00 105.00 105.00 90.00 105.00

Convert — — — 115.00 115.00

Sale $130.00 $130.00 $130.00 $130.00 $130.00

Income

LT capital gains $30.00 $25.00 $25.00 $40.00 $25.00

Ordinary — 30.00 5.00 15.00 5.00

Total $30.00 $55.00 $30.00 55.00 30.00

Taxes

LT capital gains (1) $6.00 $5.00 $5.00 $8.00 $5.00

Ordinary (2) — 15.00 2.50 7.50 2.50

Total $6.00 $20.00 $7.50 $15.50 $7.50

Net income $24.00 $35.00 $22.50 $39.50 $22.50

Company

Tax deduction 0 $30.00 $5.00 $15.00 $5.00

Earnings charge 0 25.00 0 15.00 0

Cash flow (3) $100.00 $87.00 $102.00 $81.00 $102.00

(1) Assumes 20% rate; Assumes 50% rate; Assumes 40% rate

(2)

(3)

Table 8-48. Comparison of junior stock purchase plans with stock option plans