Page 513 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 513

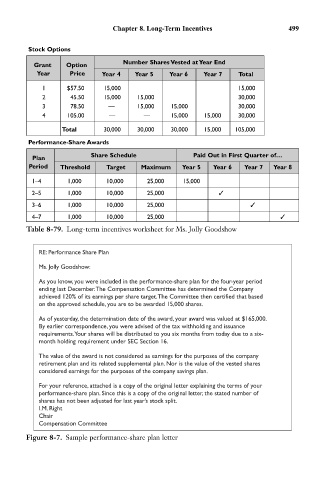

Chapter 8. Long-Term Incentives 499

Stock Options

Number Shares Vested at Year End

Grant Option

Year Price Year 4 Year 5 Year 6 Year 7 Total

1 $57.50 15,000 15,000

2 45.50 15,000 15,000 30,000

3 78.50 — 15,000 15,000 30,000

4 105.00 — — 15,000 15,000 30,000

Total 30,000 30,000 30,000 15,000 105,000

Performance-Share Awards

Share Schedule Paid Out in First Quarter of…

Plan

Period Threshold Target Maximum Year 5 Year 6 Year 7 Year 8

1–4 1,000 10,000 25,000 15,000

2–5 1,000 10,000 25,000

3–6 1,000 10,000 25,000

4–7 1,000 10,000 25,000

Table 8-79. Long-term incentives worksheet for Ms. Jolly Goodshow

RE: Performance Share Plan

Ms. Jolly Goodshow:

As you know, you were included in the performance-share plan for the four-year period

ending last December. The Compensation Committee has determined the Company

achieved 120% of its earnings per share target. The Committee then certified that based

on the approved schedule, you are to be awarded 15,000 shares.

As of yesterday, the determination date of the award, your award was valued at $165,000.

By earlier correspondence, you were advised of the tax withholding and issuance

requirements. Your shares will be distributed to you six months from today due to a six-

month holding requirement under SEC Section 16.

The value of the award is not considered as earnings for the purposes of the company

retirement plan and its related supplemental plan. Nor is the value of the vested shares

considered earnings for the purposes of the company savings plan.

For your reference, attached is a copy of the original letter explaining the terms of your

performance-share plan. Since this is a copy of the original letter, the stated number of

shares has not been adjusted for last year’s stock split.

I.M. Right

Chair

Compensation Committee

Figure 8-7. Sample performance-share plan letter