Page 74 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 74

60 The Complete Guide to Executive Compensation

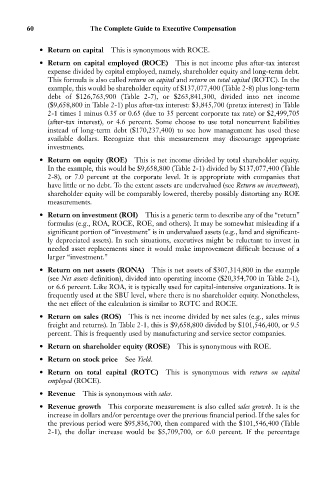

• Return on capital This is synonymous with ROCE.

• Return on capital employed (ROCE) This is net income plus after-tax interest

expense divided by capital employed, namely, shareholder equity and long-term debt.

This formula is also called return on capital and return on total capital (ROTC). In the

example, this would be shareholder equity of $137,077,400 (Table 2-8) plus long-term

debt of $126,763,900 (Table 2-7), or $263,841,300, divided into net income

($9,658,800 in Table 2-1) plus after-tax interest: $3,845,700 (pretax interest) in Table

2-1 times 1 minus 0.35 or 0.65 (due to 35 percent corporate tax rate) or $2,499,705

(after-tax interest), or 4.6 percent. Some choose to use total noncurrent liabilities

instead of long-term debt ($170,237,400) to see how management has used these

available dollars. Recognize that this measurement may discourage appropriate

investments.

• Return on equity (ROE) This is net income divided by total shareholder equity.

In the example, this would be $9,658,800 (Table 2-1) divided by $137,077,400 (Table

2-8), or 7.0 percent at the corporate level. It is appropriate with companies that

have little or no debt. To the extent assets are undervalued (see Return on investment),

shareholder equity will be comparably lowered, thereby possibly distorting any ROE

measurements.

• Return on investment (ROI) This is a generic term to describe any of the “return”

formulas (e.g., ROA, ROCE, ROE, and others). It may be somewhat misleading if a

significant portion of “investment” is in undervalued assets (e.g., land and significant-

ly depreciated assets). In such situations, executives might be reluctant to invest in

needed asset replacements since it would make improvement difficult because of a

larger “investment.”

• Return on net assets (RONA) This is net assets of $307,314,800 in the example

(see Net assets definition), divided into operating income ($20,354,700 in Table 2-1),

or 6.6 percent. Like ROA, it is typically used for capital-intensive organizations. It is

frequently used at the SBU level, where there is no shareholder equity. Nonetheless,

the net effect of the calculation is similar to ROTC and ROCE.

• Return on sales (ROS) This is net income divided by net sales (e.g., sales minus

freight and returns). In Table 2-1, this is $9,658,800 divided by $101,546,400, or 9.5

percent. This is frequently used by manufacturing and service sector companies.

• Return on shareholder equity (ROSE) This is synonymous with ROE.

• Return on stock price See Yield.

• Return on total capital (ROTC) This is synonymous with return on capital

employed (ROCE).

• Revenue This is synonymous with sales.

• Revenue growth This corporate measurement is also called sales growth. It is the

increase in dollars and/or percentage over the previous financial period. If the sales for

the previous period were $95,836,700, then compared with the $101,546,400 (Table

2-1), the dollar increase would be $5,709,700, or 6.0 percent. If the percentage