Page 195 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 195

EXISTING BUILDINGS 173

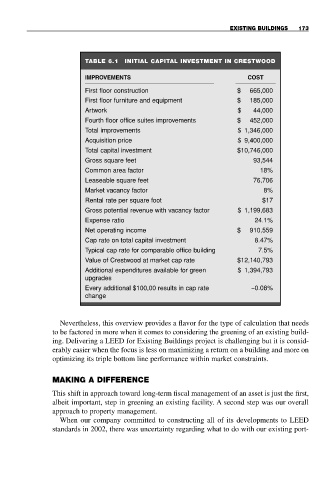

TABLE 6.1 INITIAL CAPITAL INVESTMENT IN CRESTWOOD

IMPROVEMENTS COST

First floor construction $ 665,000

First floor furniture and equipment $ 185,000

Artwork $ 44,000

Fourth floor office suites improvements $ 452,000

Total improvements $ 1,346,000

Acquisition price $ 9,400,000

Total capital investment $10,746,000

Gross square feet 93,544

Common area factor 18%

Leaseable square feet 76,706

Market vacancy factor 8%

Rental rate per square foot $17

Gross potential revenue with vacancy factor $ 1,199,683

Expense ratio 24.1%

Net operating income $ 910,559

Cap rate on total capital investment 8.47%

Typical cap rate for comparable office building 7.5%

Value of Crestwood at market cap rate $12,140,793

Additional expenditures available for green $ 1,394,793

upgrades

Every additional $100,00 results in cap rate −0.08%

change

Nevertheless, this overview provides a flavor for the type of calculation that needs

to be factored in more when it comes to considering the greening of an existing build-

ing. Delivering a LEED for Existing Buildings project is challenging but it is consid-

erably easier when the focus is less on maximizing a return on a building and more on

optimizing its triple bottom line performance within market constraints.

MAKING A DIFFERENCE

This shift in approach toward long-term fiscal management of an asset is just the first,

albeit important, step in greening an existing facility. A second step was our overall

approach to property management.

When our company committed to constructing all of its developments to LEED

standards in 2002, there was uncertainty regarding what to do with our existing port-