Page 93 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 93

72 CHAPTER 2

ears

Y Years 0 1 2 3

REVENUES/SAVINGS

REVENUES/SA VINGS

21,300

21,300

21,300

Revenues fr om Chapter 1 21,300 21,300 21,300

Revenues from Chapter 1

om

Revenues from Chapter 2 2

fr

Revenues

Chapter

79,000

members

Retaining

79,000

Retaining key staff members 79,000 79,000 79,000

79,000

staff

key

Total rotal revenues frevenues from Chapterom Chapter 22 79,000 79,000 79,000

79,000

79,000

79,000

evenues

(Chapters

&

1

r

2)

100,300

100,300

Sub-total of all revenues (Chapters 1 & 2) 100,300 100,300 100,300

Sub-total

of

100,300

all

COSTS

COSTS

Costs from Chapter 1

(166,000)

Costs fr om Chapter 1 (166,000) (1 (114,500) (91,875) (97,286)

(91,875)

14,500)

(97,286)

om

Costs

fr

Chapter

Costs from Chapter 2 2

fr

om

(61,992)

Opportunity

gr

(46,875)

(53,906)

een

glue

Lost

Lost Opportunity from green glue (46,875) (53,906) (61,992)

Cost of facilitator's time (10,725) (10,725) (10,725)

(10,725)

(10,725)

Cost of facilitator's time

(10,725)

(72,717)

(64,631)

Total costs frotal costs from Chapterom Chapter 22 (57,600) (64,631) (72,717)

(57,600)

Sub-total of all costs (Chapters 1 & 2) (166,000) (172,100) (156,506) (170,003)

(166,000)

(172,100)

(156,506)

Sub-total of all costs (Chapters 1 & 2)

(170,003)

(69,703)

(71,800)

(166,000)

Total Cashflowotal Cashflow (166,000) (71,800) (56,206) (69,703)

(56,206)

Discount Factor 1.000 0.909 0.826 0.751

0.909

0.751

Factor

0.826

1.000

Discount

(52,369)

(46,451)

PV Cashflow

(65,273)

PV Cashflow (166,000) (65,273) (46,451) (52,369)

(166,000)

NPV 335,955

NPV

335,955

20.85%

IRR 20.85%

IRR

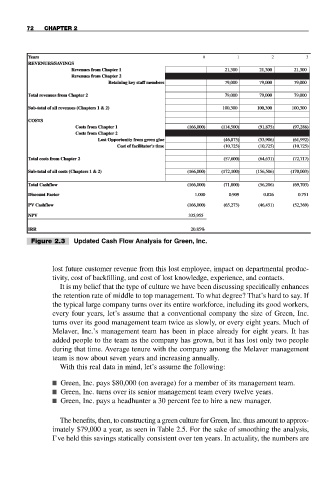

Figure 2.3 Updated Cash Flow Analysis for Green, Inc.

lost future customer revenue from this lost employee, impact on departmental produc-

tivity, cost of backfilling, and cost of lost knowledge, experience, and contacts.

It is my belief that the type of culture we have been discussing specifically enhances

the retention rate of middle to top management. To what degree? That’s hard to say. If

the typical large company turns over its entire workforce, including its good workers,

every four years, let’s assume that a conventional company the size of Green, Inc.

turns over its good management team twice as slowly, or every eight years. Much of

Melaver, Inc.’s management team has been in place already for eight years. It has

added people to the team as the company has grown, but it has lost only two people

during that time. Average tenure with the company among the Melaver management

team is now about seven years and increasing annually.

With this real data in mind, let’s assume the following:

■ Green, Inc. pays $80,000 (on average) for a member of its management team.

■ Green, Inc. turns over its senior management team every twelve years.

■ Green, Inc. pays a headhunter a 30 percent fee to hire a new manager.

The benefits, then, to constructing a green culture for Green, Inc. thus amount to approx-

imately $79,000 a year, as seen in Table 2.5. For the sake of smoothing the analysis,

I’ve held this savings statically consistent over ten years. In actuality, the numbers are