Page 221 - Toyota Under Fire

P. 221

TOYOT A UNDER FIRE

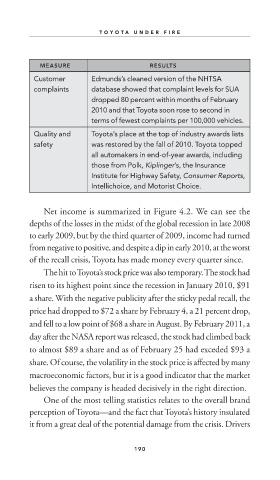

MEASURE RESULTS

Customer Edmunds’s cleaned version of the NHTSA

complaints database showed that complaint levels for SUA

dropped 80 percent within months of February

2010 and that Toyota soon rose to second in

terms of fewest complaints per 100,000 vehicles.

Quality and Toyota’s place at the top of industry awards lists

safety was restored by the fall of 2010. Toyota topped

all automakers in end-of-year awards, including

those from Polk, Kiplinger’s, the Insurance

Institute for Highway Safety, Consumer Reports,

Intellichoice, and Motorist Choice.

Net income is summarized in Figure 4.2. We can see the

depths of the losses in the midst of the global recession in late 2008

to early 2009, but by the third quarter of 2009, income had turned

from negative to positive, and despite a dip in early 2010, at the worst

of the recall crisis, Toyota has made money every quarter since.

The hit to Toyota’s stock price was also temporary. The stock had

risen to its highest point since the recession in January 2010, $91

a share. With the negative publicity after the sticky pedal recall, the

price had dropped to $72 a share by February 4, a 21 percent drop,

and fell to a low point of $68 a share in August. By February 2011, a

day after the NASA report was released, the stock had climbed back

to almost $89 a share and as of February 25 had exceded $93 a

share. Of course, the volatility in the stock price is affected by many

macroeconomic factors, but it is a good indicator that the market

believes the company is headed decisively in the right direction.

One of the most telling statistics relates to the overall brand

perception of Toyota—and the fact that Toyota’s history insulated

it from a great deal of the potential damage from the crisis. Drivers

190