Page 265 - Urban Construction Project Management

P. 265

220 Chapter Ten

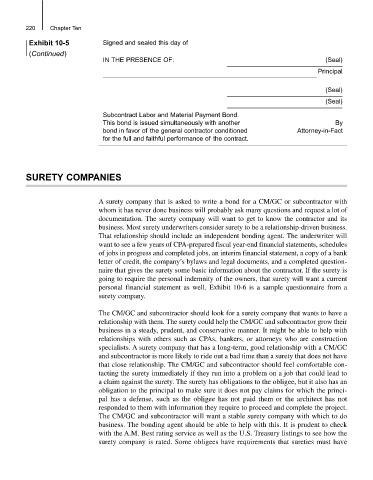

Exhibit 10-5 Signed and sealed this day of

(Continued)

IN THE PRESENCE OF: (Seal)

Principal

(Seal)

(Seal)

Subcontract Labor and Material Payment Bond.

This bond is issued simultaneously with another By

bond in favor of the general contractor conditioned Attorney-in-Fact

for the full and faithful performance of the contract.

SURETY COMPANIES

A surety company that is asked to write a bond for a CM/GC or subcontractor with

whom it has never done business will probably ask many questions and request a lot of

documentation. The surety company will want to get to know the contractor and its

business. Most surety underwriters consider surety to be a relationship-driven business.

That relationship should include an independent bonding agent. The underwriter will

want to see a few years of CPA-prepared fiscal year-end financial statements, schedules

of jobs in progress and completed jobs, an interim financial statement, a copy of a bank

letter of credit, the company’s bylaws and legal documents, and a completed question-

naire that gives the surety some basic information about the contractor. If the surety is

going to require the personal indemnity of the owners, that surety will want a current

personal financial statement as well. Exhibit 10-6 is a sample questionnaire from a

surety company.

The CM/GC and subcontractor should look for a surety company that wants to have a

relationship with them. The surety could help the CM/GC and subcontractor grow their

business in a steady, prudent, and conservative manner. It might be able to help with

relationships with others such as CPAs, bankers, or attorneys who are construction

specialists. A surety company that has a long-term, good relationship with a CM/GC

and subcontractor is more likely to ride out a bad time than a surety that does not have

that close relationship. The CM/GC and subcontractor should feel comfortable con-

tacting the surety immediately if they run into a problem on a job that could lead to

a claim against the surety. The surety has obligations to the obligee, but it also has an

obligation to the principal to make sure it does not pay claims for which the princi-

pal has a defense, such as the obligee has not paid them or the architect has not

responded to them with information they require to proceed and complete the project.

The CM/GC and subcontractor will want a stable surety company with which to do

business. The bonding agent should be able to help with this. It is prudent to check

with the A.M. Best rating service as well as the U.S. Treasury listings to see how the

surety company is rated. Some obligees have requirements that sureties must have