Page 269 - Urban Construction Project Management

P. 269

224 Chapter Ten

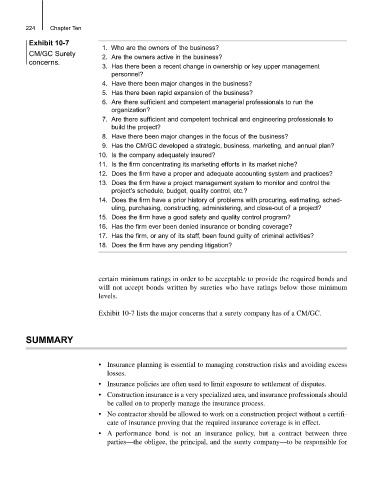

Exhibit 10-7

1. Who are the owners of the business?

CM/GC Surety

2. Are the owners active in the business?

concerns.

3. Has there been a recent change in ownership or key upper management

personnel?

4. Have there been major changes in the business?

5. Has there been rapid expansion of the business?

6. Are there sufficient and competent managerial professionals to run the

organization?

7. Are there sufficient and competent technical and engineering professionals to

build the project?

8. Have there been major changes in the focus of the business?

9. Has the CM/GC developed a strategic, business, marketing, and annual plan?

10. Is the company adequately insured?

11. Is the firm concentrating its marketing efforts in its market niche?

12. Does the firm have a proper and adequate accounting system and practices?

13. Does the firm have a project management system to monitor and control the

project’s schedule, budget, quality control, etc.?

14. Does the firm have a prior history of problems with procuring, estimating, sched-

uling, purchasing, constructing, administering, and close-out of a project?

15. Does the firm have a good safety and quality control program?

16. Has the firm ever been denied insurance or bonding coverage?

17. Has the firm, or any of its staff, been found guilty of criminal activities?

18. Does the firm have any pending litigation?

certain minimum ratings in order to be acceptable to provide the required bonds and

will not accept bonds written by sureties who have ratings below those minimum

levels.

Exhibit 10-7 lists the major concerns that a surety company has of a CM/GC.

SUMMARY

• Insurance planning is essential to managing construction risks and avoiding excess

losses.

• Insurance policies are often used to limit exposure to settlement of disputes.

• Construction insurance is a very specialized area, and insurance professionals should

be called on to properly manage the insurance process.

• No contractor should be allowed to work on a construction project without a certifi-

cate of insurance proving that the required insurance coverage is in effect.

• A performance bond is not an insurance policy, but a contract between three

parties—the obligee, the principal, and the surety company—to be responsible for