Page 179 - Accounting Best Practices

P. 179

c09.qxd 7/31/03 3:08 PM Page 168

168

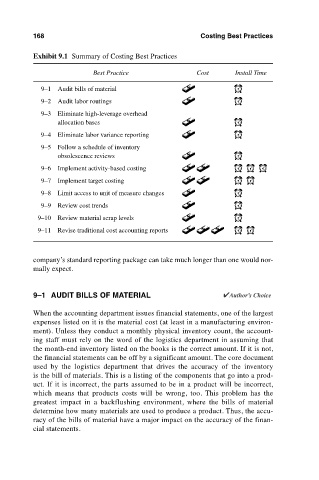

Exhibit 9.1 Summary of Costing Best Practices Costing Best Practices

Best Practice Cost Install Time

9–1 Audit bills of material

9–2 Audit labor routings

9–3 Eliminate high-leverage overhead

allocation bases

9–4 Eliminate labor variance reporting

9–5 Follow a schedule of inventory

obsolescence reviews

9–6 Implement activity-based costing

9–7 Implement target costing

9–8 Limit access to unit of measure changes

9–9 Review cost trends

9–10 Review material scrap levels

9–11 Revise traditional cost accounting reports

company’s standard reporting package can take much longer than one would nor-

mally expect.

9–1 AUDIT BILLS OF MATERIAL

When the accounting department issues financial statements, one of the largest

expenses listed on it is the material cost (at least in a manufacturing environ-

ment). Unless they conduct a monthly physical inventory count, the account-

ing staff must rely on the word of the logistics department in assuming that

the month-end inventory listed on the books is the correct amount. If it is not,

the financial statements can be off by a significant amount. The core document

used by the logistics department that drives the accuracy of the inventory

is the bill of materials. This is a listing of the components that go into a prod-

uct. If it is incorrect, the parts assumed to be in a product will be incorrect,

which means that products costs will be wrong, too. This problem has the

greatest impact in a backflushing environment, where the bills of material

determine how many materials are used to produce a product. Thus, the accu-

racy of the bills of material have a major impact on the accuracy of the finan-

cial statements.