Page 262 - Accounting Information Systems

P. 262

C H A P TER 5 The Expenditure Cycle Part I: Purchases and Cash Disbursements Procedures 233

FI G U R E

5-13 CASH DISBURSEMENTS SYSTEM

Accounts Payable Cash Disbursements General Ledger

Open

Voucher PO

File RR

Invoice Prepare

Search Open Checks

Voucher File for Purchase Cash Disb.

Items Due Order Voucher Check

Receiving Register A Summary Journal

Report Voucher

Journal

Invoice 3 Voucher

2

Cash Disb. 1 Post to GL

from Journal

Voucher Check

Voucher and

Reconcile GL

to Summary

PO

PO RR Summary General

RR Invoice Ledger

Invoice Journal

Cash Disb.

Cash Disb. Voucher Voucher

Voucher

Sign

Checks

Close File

Voucher Voucher PO Check

Register and File RR (Copy)

Invoice

Summary PO Cash Disb.

RR Voucher

Invoice Check File

CD (Copy) Check

A Voucher

Check

(Copy)

Supplier

Closed

Voucher

File

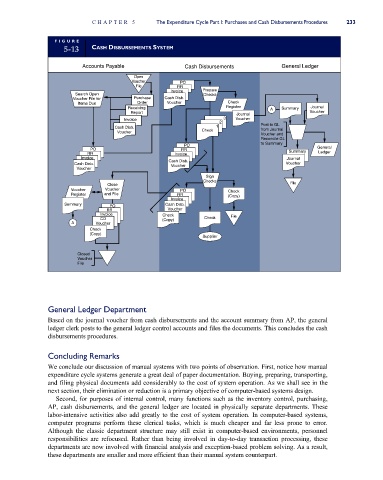

General Ledger Department

Based on the journal voucher from cash disbursements and the account summary from AP, the general

ledger clerk posts to the general ledger control accounts and files the documents. This concludes the cash

disbursements procedures.

Concluding Remarks

We conclude our discussion of manual systems with two points of observation. First, notice how manual

expenditure cycle systems generate a great deal of paper documentation. Buying, preparing, transporting,

and filing physical documents add considerably to the cost of system operation. As we shall see in the

next section, their elimination or reduction is a primary objective of computer-based systems design.

Second, for purposes of internal control, many functions such as the inventory control, purchasing,

AP, cash disbursements, and the general ledger are located in physically separate departments. These

labor-intensive activities also add greatly to the cost of system operation. In computer-based systems,

computer programs perform these clerical tasks, which is much cheaper and far less prone to error.

Although the classic department structure may still exist in computer-based environments, personnel

responsibilities are refocused. Rather than being involved in day-to-day transaction processing, these

departments are now involved with financial analysis and exception-based problem solving. As a result,

these departments are smaller and more efficient than their manual system counterpart.