Page 313 - Accounting Information Systems

P. 313

284 PART II Transaction Cycles and Business Processes

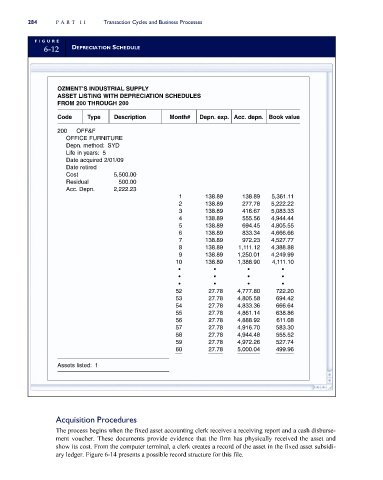

FI G U RE

6-12 DEPRECIATION SCHEDULE

OZMENT’S INDUSTRIAL SUPPLY

ASSET LISTING WITH DEPRECIATION SCHEDULES

FROM 200 THROUGH 200

Code Type Description Month# Depn. exp. Acc. depn. Book value

200 OFF&F

OFFICE FURNITURE

Depn. method: SYD

Life in years: 5

Date acquired 2/01/09

Date retired

Cost 5,500.00

Residual 500.00

Acc. Depn. 2,222.23

1 138.89 138.89 5,361.11

2 138.89 277.78 5,222.22

3 138.89 416.67 5,083.33

4 138.89 555.56 4,944.44

5 138.89 694.45 4,805.55

6 138.89 833.34 4,666.66

7 138.89 972.23 4,527.77

8 138.89 1,111.12 4,388.88

9 138.89 1,250.01 4,249.99

10 138.89 1,388.90 4,111.10

• • • •

• • • •

• • • •

52 27.78 4,777.80 722.20

53 27.78 4,805.58 694.42

54 27.78 4,833.36 666.64

55 27.78 4,861.14 638.86

56 27.78 4,888.92 611.08

57 27.78 4,916.70 583.30

58 27.78 4,944.48 555.52

59 27.78 4,972.26 527.74

60 27.78 5,000.04 499.96

Assets listed: 1

Acquisition Procedures

The process begins when the fixed asset accounting clerk receives a receiving report and a cash disburse-

ment voucher. These documents provide evidence that the firm has physically received the asset and

show its cost. From the computer terminal, a clerk creates a record of the asset in the fixed asset subsidi-

ary ledger. Figure 6-14 presents a possible record structure for this file.