Page 314 - Accounting Information Systems

P. 314

CHAPTE R 6 The Expenditure Cycle Part II: Payroll Processing and Fixed Asset Procedures 285

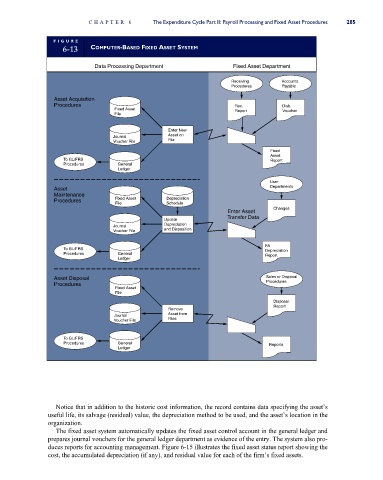

FI G U R E

6-13 COMPUTER-BASED FIXED ASSET SYSTEM

Data Processing Department Fixed Asset Department

Receiving Accounts

Procedures Payable

Asset Acquisition

Procedures Rec. Disb.

Fixed Asset Report Voucher

File

Enter New

Journal Asset on

Voucher File File

Fixed

Asset

To GL/FRS Report

Procedures General

Ledger

User

Departments

Asset

Maintenance

Procedures Fixed Asset Depreciation

File Schedule

Changes

Enter Asset

Transfer Data

Update

Journal Depreciation

Voucher File and Disposition

FA

To GL/FRS Depreciation

Procedures General Report

Ledger

Asset Disposal Sales or Disposal

Procedures

Procedures

Fixed Asset

File

Disposal

Report

Remove

Journal Asset from

Voucher File Files

To GL/FRS

Procedures General Reports

Ledger

Notice that in addition to the historic cost information, the record contains data specifying the asset’s

useful life, its salvage (residual) value, the depreciation method to be used, and the asset’s location in the

organization.

The fixed asset system automatically updates the fixed asset control account in the general ledger and

prepares journal vouchers for the general ledger department as evidence of the entry. The system also pro-

duces reports for accounting management. Figure 6-15 illustrates the fixed asset status report showing the

cost, the accumulated depreciation (if any), and residual value for each of the firm’s fixed assets.