Page 358 - Accounting Information Systems

P. 358

C H A P TER 7 The Conversion Cycle 329

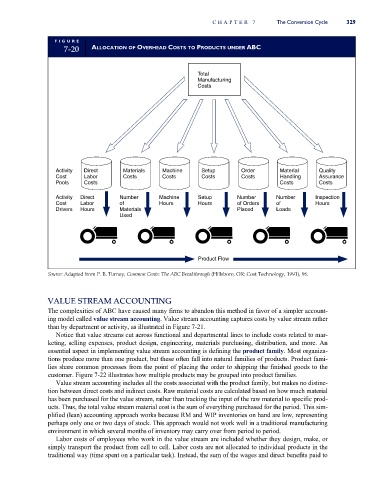

FI G U R E

7-20 ALLOCATION OF OVERHEAD COSTS TO PRODUCTS UNDER ABC

Total

Manufacturing

Costs

Activity Direct Materials Machine Setup Order Material Quality

Cost Labor Costs Costs Costs Handling Assurance

Costs

Pools Costs Costs Costs

Activity Direct Number Machine Setup Number Number Inspection

Cost Labor of Hours Hours of Orders of Hours

Drivers Hours Materials Placed Loads

Used

Product Flow

Source: Adapted from P. B. Turney, Common Cents: The ABC Breakthrough (Hillsboro, OR: Cost Technology, 1991), 96.

VALUE STREAM ACCOUNTING

The complexities of ABC have caused many firms to abandon this method in favor of a simpler account-

ing model called value stream accounting. Value stream accounting captures costs by value stream rather

than by department or activity, as illustrated in Figure 7-21.

Notice that value streams cut across functional and departmental lines to include costs related to mar-

keting, selling expenses, product design, engineering, materials purchasing, distribution, and more. An

essential aspect in implementing value stream accounting is defining the product family. Most organiza-

tions produce more than one product, but these often fall into natural families of products. Product fami-

lies share common processes from the point of placing the order to shipping the finished goods to the

customer. Figure 7-22 illustrates how multiple products may be grouped into product families.

Value stream accounting includes all the costs associated with the product family, but makes no distinc-

tion between direct costs and indirect costs. Raw material costs are calculated based on how much material

has been purchased for the value stream, rather than tracking the input of the raw material to specific prod-

ucts. Thus, the total value stream material cost is the sum of everything purchased for the period. This sim-

plified (lean) accounting approach works because RM and WIP inventories on hand are low, representing

perhaps only one or two days of stock. This approach would not work well in a traditional manufacturing

environment in which several months of inventory may carry over from period to period.

Labor costs of employees who work in the value stream are included whether they design, make, or

simply transport the product from cell to cell. Labor costs are not allocated to individual products in the

traditional way (time spent on a particular task). Instead, the sum of the wages and direct benefits paid to