Page 146 -

P. 146

126 CHAPTER 3 LINEAR PROGRAMMING: SENSITIVITY ANALYSIS AND INTERPRETATION OF SOLUTION

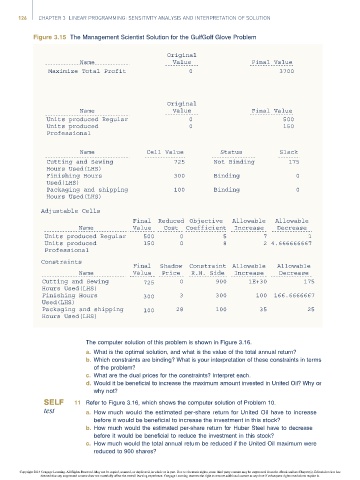

Figure 3.15 The Management Scientist Solution for the GulfGolf Glove Problem

Original

Name Value Final Value

Maximize Total Profit 0 3700

Original

Name Value Final Value

Units produced Regular 0 500

Units produced 0 150

Professional

Name Cell Value Status Slack

Cutting and Sewing 725 Not Binding 175

Hours Used(LHS)

Finishing Hours 300 Binding 0

Used(LHS)

Packaging and shipping 100 Binding 0

Hours Used(LHS)

Adjustable Cells

Final Reduced Objective Allowable Allowable

Name Value Cost Coefficient Increase Decrease

Units produced Regular 500 0 5 7 1

Units produced 150 0 8 2 4.666666667

Professional

Constraints

Final Shadow Constraint Allowable Allowable

Name Value Price R.H. Side Increase Decrease

Cutting and Sewing 725 0 900 1E+30 175

Hours Used(LHS)

Finishing Hours 300 3 300 100 166.6666667

Used(LHS)

Packaging and shipping 100 28 100 35 25

Hours Used(LHS)

The computer solution of this problem is shown in Figure 3.16.

a. What is the optimal solution, and what is the value of the total annual return?

b. Which constraints are binding? What is your interpretation of these constraints in terms

of the problem?

c. What are the dual prices for the constraints? Interpret each.

d. Would it be beneficial to increase the maximum amount invested in United Oil? Why or

why not?

11 Refer to Figure 3.16, which shows the computer solution of Problem 10.

a. Howmuch would theestimated per-share return for United Oilhaveto increase

before it would be beneficial to increase the investment in this stock?

b. How much would the estimated per-share return for Huber Steel have to decrease

before it would be beneficial to reduce the investment in this stock?

c. How much would the total annual return be reduced if the United Oil maximum were

reduced to 900 shares?

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.