Page 147 -

P. 147

THE TAIWAN ELECTRONIC COMMUNICATIONS (TEC) PROBLEM 127

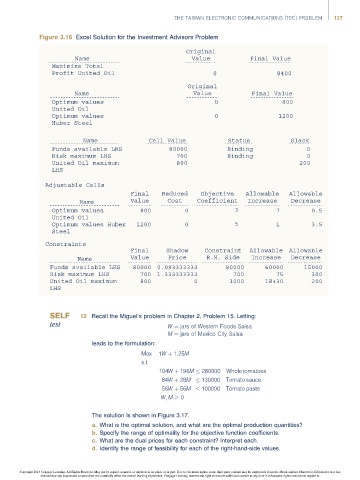

Figure 3.16 Excel Solution for the Investment Advisors Problem

Original

Name Value Final Value

Maximize Total

Profit United Oil 0 8400

Original

Name Value Final Value

Optimum values 0 800

United Oil

Optimum values 0 1200

Huber Steel

Name Cell Value Status Slack

Funds available LHS 80000 Binding 0

Risk maximum LHS 700 Binding 0

United Oil maximum 800 200

LHS

Adjustable Cells

Final Reduced Objective Allowable Allowable

Name Value Cost Coefficient Increase Decrease

Optimum values 800 0 3 7 0.5

United Oil

Optimum values Huber 1200 0 5 1 3.5

Steel

Constraints

Final Shadow Constraint Allowable Allowable

Name Value Price R.H. Side Increase Decrease

Funds available LHS 80000 0.093333333 80000 60000 15000

Risk maximum LHS 700 1.333333333 700 75 300

United Oil maximum 800 0 1000 1E+30 200

LHS

12 Recall the Miguel’s problem in Chapter 2, Problem 15. Letting:

W ¼ jars of Western Foods Salsa

M ¼ jars of Mexico City Salsa

leads to the formulation:

Max 1W þ 1:25M

s:t

104W þ 196M 280000 Whole tomatoes

84W þ 28M 130000 Tomato sauce

56W þ 56M 100000 Tomato paste

W; M 0

The solution is shown in Figure 3.17.

a. What is the optimal solution, and what are the optimal production quantities?

b. Specify the range of optimality for the objective function coefficients.

c. What are the dual prices for each constraint? Interpret each.

d. Identify the range of feasibility for each of the right-hand-side values.

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.