Page 152 -

P. 152

132 CHAPTER 3 LINEAR PROGRAMMING: SENSITIVITY ANALYSIS AND INTERPRETATION OF SOLUTION

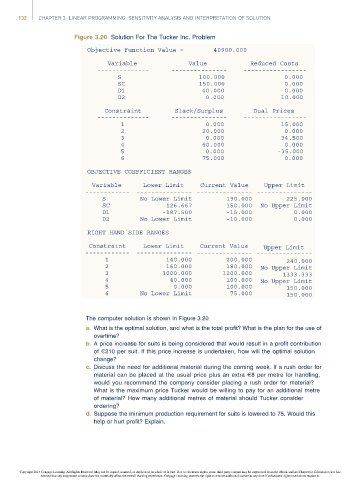

Figure 3.20 Solution For The Tucker Inc. Problem

Objective Function Value = 40900.000

Variable Value Reduced Costs

-------------- --------------- -----------------

S 100.000 0.000

SC 150.000 0.000

D1 40.000 0.000

D2 0.000 10.000

Constraint Slack/Surplus Dual Prices

-------------- --------------- -----------------

1 0.000 15.000

2 20.000 0.000

3 0.000 34.500

4 60.000 0.000

5 0.000 -35.000

6 75.000 0.000

OBJECTIVE COEFFICIENT RANGES

Variable Lower Limit Current Value Upper Limit

------------ --------------- --------------- ---------------

S No Lower Limit 190.000 225.000

SC 126.667 150.000 No Upper Limit

D1 -187.500 -15.000 0.000

D2 No Lower Limit -10.000 0.000

RIGHT HAND SIDE RANGES

Constraint Lower Limit Current Value Upper Limit

------------ --------------- --------------- ---------------

1 140.000 200.000 240.000

2 160.000 180.000 No Upper Limit

3 1000.000 1200.000 1333.333

4 40.000 100.000 No Upper Limit

5 0.000 100.000 150.000

6 No Lower Limit 75.000 150.000

The computer solution is shown in Figure 3.20.

a. What is the optimal solution, and what is the total profit? What is the plan for the use of

overtime?

b. A price increase for suits is being considered that would result in a profit contribution

of E210 per suit. If this price increase is undertaken, how will the optimal solution

change?

c. Discuss the need for additional material during the coming week. If a rush order for

material can be placed at the usual price plus an extra E8per metrefor handling,

would you recommend the company consider placing a rush order for material?

What is the maximum price Tucker would be willing to pay for an additional metre

of material? How many additional metres of material should Tucker consider

ordering?

d. Suppose the minimum production requirement for suits is lowered to 75. Would this

help or hurt profit? Explain.

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.