Page 153 -

P. 153

THE TAIWAN ELECTRONIC COMMUNICATIONS (TEC) PROBLEM 133

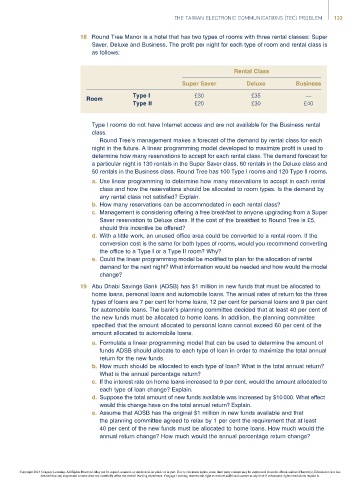

18 Round Tree Manor is a hotel that has two types of rooms with three rental classes: Super

Saver, Deluxe and Business. The profit per night for each type of room and rental class is

as follows:

Rental Class

Super Saver Deluxe Business

Type I £30 £35 —

Room

Type II £20 £30 £40

Type I rooms do not have Internet access and are not available for the Business rental

class.

Round Tree’s management makes a forecast of the demand by rental class for each

night in the future. A linear programming model developed to maximize profit is used to

determine how many reservations to accept for each rental class. The demand forecast for

a particular night is 130 rentals in the Super Saver class, 60 rentals in the Deluxe class and

50 rentals in the Business class. Round Tree has 100 Type I rooms and 120 Type II rooms.

a. Use linear programming to determine how many reservations to accept in each rental

class and how the reservations should be allocated to room types. Is the demand by

any rental class not satisfied? Explain.

b. How many reservations can be accommodated in each rental class?

c. Management is considering offering a free breakfast to anyone upgrading from a Super

Saver reservation to Deluxe class. If the cost of the breakfast to Round Tree is £5,

should this incentive be offered?

d. With a little work, an unused office area could be converted to a rental room. If the

conversion cost is the same for both types of rooms, would you recommend converting

the office to a Type I or a Type II room? Why?

e. Could the linear programming model be modified to plan for the allocation of rental

demand for the next night? What information would be needed and how would the model

change?

19 Abu Dhabi Savings Bank (ADSB) has $1 million in new funds that must be allocated to

home loans, personal loans and automobile loans. The annual rates of return for the three

types of loans are 7 per cent for home loans, 12 per cent for personal loans and 9 per cent

for automobile loans. The bank’s planning committee decided that at least 40 per cent of

the new funds must be allocated to home loans. In addition, the planning committee

specified that the amount allocated to personal loans cannot exceed 60 per cent of the

amount allocated to automobile loans.

a. Formulate a linear programming model that can be used to determine the amount of

funds ADSB should allocate to each type of loan in order to maximize the total annual

return for the new funds.

b. How much should be allocated to each type of loan? What is the total annual return?

What is the annual percentage return?

c. If the interest rate on home loans increased to 9 per cent, would the amount allocated to

each type of loan change? Explain.

d. Suppose the total amount of new funds available was increased by $10000. What effect

would this change have on the total annual return? Explain.

e. Assume that ADSB has the original $1 million in new funds available and that

the planning committee agreed to relax by 1 per cent the requirement that at least

40 per cent of the new funds must be allocated to home loans. How much would the

annual return change? How much would the annual percentage return change?

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.