Page 188 -

P. 188

168 CHAPTER 4 LINEAR PROGRAMMING APPLICATIONS

Min 20DC þ 25EC þ 18DNC þ 20ENC

s:t:

DC þ EC þ DNC þ ENC ¼ 1000 Total interviews

DC þ EC 400 Households with children

DNC þ ENC 400 Households without children

DC þ EC DNC þ ENC 0 Evening interviews

0:4DC þ 0:6EC 0 Evening interviews

in households with children

0:6DNC þ 0:4ENC 0 Evening interviews

in households without children

DC; EC; DNC; ENC 0

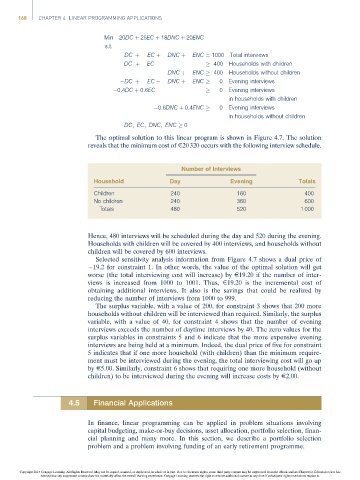

The optimal solution to this linear program is shown in Figure 4.7. The solution

reveals that the minimum cost of E20320 occurs with the following interview schedule.

Number of Interviews

Household Day Evening Totals

Children 240 160 400

No children 240 360 600

Totals 480 520 1 000

Hence, 480 interviews will be scheduled during the day and 520 during the evening.

Households with children will be covered by 400 interviews, and households without

children will be covered by 600 interviews.

Selected sensitivity analysis information from Figure 4.7 shows a dual price of

19.2 for constraint 1. In other words, the value of the optimal solution will get

worse (the total interviewing cost will increase) by E19.20 if the number of inter-

views is increased from 1000 to 1001. Thus, E19.20 is the incremental cost of

obtaining additional interviews. It also is the savings that could be realized by

reducing the number of interviews from 1000 to 999.

The surplus variable, with a value of 200, for constraint 3 shows that 200 more

households without children will be interviewed than required. Similarly, the surplus

variable, with a value of 40, for constraint 4 shows that the number of evening

interviews exceeds the number of daytime interviews by 40. The zero values for the

surplus variables in constraints 5 and 6 indicate that the more expensive evening

interviews are being held at a minimum. Indeed, the dual price of five for constraint

5 indicates that if one more household (with children) than the minimum require-

ment must be interviewed during the evening, the total interviewing cost will go up

by E5.00. Similarly, constraint 6 shows that requiring one more household (without

children) to be interviewed during the evening will increase costs by E2.00.

4.5 Financial Applications

In finance, linear programming can be applied in problem situations involving

capital budgeting, make-or-buy decisions, asset allocation, portfolio selection, finan-

cial planning and many more. In this section, we describe a portfolio selection

problem and a problem involving funding of an early retirement programme.

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.