Page 193 -

P. 193

FINANCIAL APPLICATIONS 173

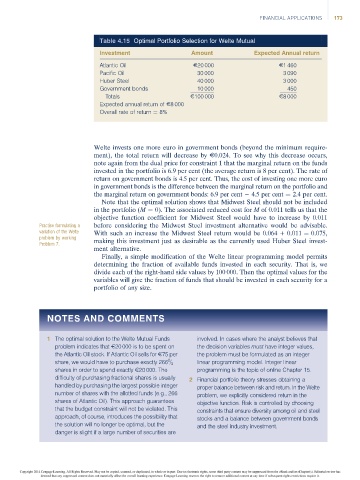

Table 4.15 Optimal Portfolio Selection for Welte Mutual

Investment Amount Expected Annual return

Atlantic Oil E20 000 E1 460

Pacific Oil 30 000 3 090

Huber Steel 40 000 3 000

Government bonds 10 000 450

Totals E100 000 E8 000

Expected annual return of E8 000

Overall rate of return ¼ 8%

Welte invests one more euro in government bonds (beyond the minimum require-

ment), the total return will decrease by E0.024. To see why this decrease occurs,

note again from the dual price for constraint 1 that the marginal return on the funds

invested in the portfolio is 6.9 per cent (the average return is 8 per cent). The rate of

return on government bonds is 4.5 per cent. Thus, the cost of investing one more euro

in government bonds is the difference between the marginal return on the portfolio and

the marginal return on government bonds: 6.9 per cent 4.5 per cent ¼ 2.4 per cent.

Note that the optimal solution shows that Midwest Steel should not be included

in the portfolio (M ¼ 0). The associated reduced cost for M of 0.011 tells us that the

objective function coefficient for Midwest Steel would have to increase by 0.011

Practise formulating a before considering the Midwest Steel investment alternative would be advisable.

variation of the Welte With such an increase the Midwest Steel return would be 0.064 + 0.011 ¼ 0.075,

problem by working

Problem 7. making this investment just as desirable as the currently used Huber Steel invest-

ment alternative.

Finally, a simple modification of the Welte linear programming model permits

determining the fraction of available funds invested in each security. That is, we

divide each of the right-hand side values by 100 000. Then the optimal values for the

variables will give the fraction of funds that should be invested in each security for a

portfolio of any size.

NOTES AND COMMENTS

1 The optimal solution to the Welte Mutual Funds involved. In cases where the analyst believes that

problem indicates that E20 000 is to be spent on the decision variables must have integer values,

the Atlantic Oil stock. If Atlantic Oil sells for E75 per the problem must be formulated as an integer

2

share, we would have to purchase exactly 266 / 3 linear programming model. Integer linear

shares in order to spend exactly E20000. The programming is the topic of online Chapter 15.

difficulty of purchasing fractional shares is usually 2 Financial portfolio theory stresses obtaining a

handled by purchasing the largest possible integer proper balance between risk and return. In the Welte

number of shares with the allotted funds (e.g., 266 problem, we explicitly considered return in the

shares of Atlantic Oil). This approach guarantees objective function. Risk is controlled by choosing

that the budget constraint will not be violated. This constraints that ensure diversity among oil and steel

approach, of course, introduces the possibility that stocks and a balance between government bonds

the solution will no longer be optimal, but the and the steel industry investment.

danger is slight if a large number of securities are

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.