Page 197 -

P. 197

FINANCIAL APPLICATIONS 177

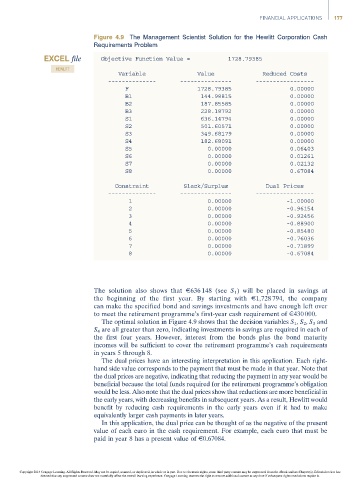

Figure 4.9 The Management Scientist Solution for the Hewlitt Corporation Cash

Requirements Problem

EXCEL file Objective Function Value = 1728.79385

HEWLITT

Variable Value Reduced Costs

-------------- --------------- -----------------

F 1728.79385 0.00000

B1 144.98815 0.00000

B2 187.85585 0.00000

B3 228.18792 0.00000

S1 636.14794 0.00000

S2 501.60571 0.00000

S3 349.68179 0.00000

S4 182.68091 0.00000

S5 0.00000 0.06403

S6 0.00000 0.01261

S7 0.00000 0.02132

S8 0.00000 0.67084

Constraint Slack/Surplus Dual Prices

-------------- --------------- -----------------

1 0.00000 -1.00000

2 0.00000 -0.96154

3 0.00000 -0.92456

4 0.00000 -0.88900

5 0.00000 -0.85480

6 0.00000 -0.76036

7 0.00000 -0.71899

8 0.00000 -0.67084

The solution also shows that E636 148 (see S 1 ) will be placed in savings at

thebeginning of thefirst year.Bystartingwith E1,728 794, the company

can make the specified bond and savings investments and have enough left over

to meet the retirement programme’s first-year cash requirement of E430 000.

The optimal solution in Figure 4.9 shows that the decision variables S 1 , S 2 , S 3 and

S 4 are all greater than zero, indicating investments in savings are required in each of

the first four years. However, interest from the bonds plus the bond maturity

incomes will be sufficient to cover the retirement programme’s cash requirements

in years 5 through 8.

The dual prices have an interesting interpretation in this application. Each right-

hand side value corresponds to the payment that must be made in that year. Note that

the dual prices are negative, indicating that reducing the payment in any year would be

beneficial because the total funds required for the retirement programme’s obligation

would be less. Also note that the dual prices show that reductions are more beneficial in

the early years, with decreasing benefits in subsequent years. As a result, Hewlitt would

benefit by reducing cash requirements in the early years even if it had to make

equivalently larger cash payments in later years.

In this application, the dual price can be thought of as the negative of the present

value of each euro in the cash requirement. For example, each euro that must be

paid in year 8 has a present value of E0.67084.

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.