Page 60 - Applied Process Design for Chemical and Petrochemical Plants Volume I

P. 60

48 Applied Process Design for Chemical and Petrochemical Plants

Return =

EC, = ECl(?] (Gross savings -Depreciation x Investment ) (1-Federal Tax )

Investment

where I, = index value for year represented by 2, (usually Example 1-2: Justifiable Investment For Annual

current) Savings [6]

I, = index value for earlier year represented by 1.

EC, = equipment estimated cost for year represented Find the justifiable investment for a gross annual sav-

by 2. ings of $15,000 when a return of 10% and a depreciation

EC1 = equipment purchased cost (when available) for rate of 15 percent are specified.

year represented by 1.

1. From Figure 1-40, connect scales A and B.

2. From the intersection with the C scale, connect a

line to the D scale.

3. At the intersection of line (2) with the inclined

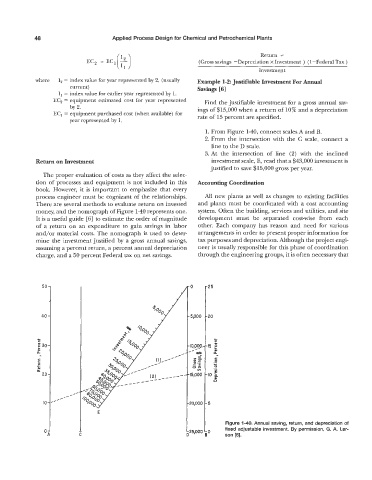

Return on Investment investment scale, E, read that a $43,000 investment is

justified to save $15,000 gross per year.

The proper evaluation of costs as they affect the selec-

tion of processes and equipment is not included in this Accounting Coordination

book. However, it is important to emphasize that every

process engineer must be cognizant of the relationships. All new plants as well as changes to existing facilities

There are several methods to evaluate return on invested and plants must be coordinated with a cost accounting

money, and the nomograph of Figure 1-40 represents one. system. Often the building, services and utilities, and site

It is a useful guide [6] to estimate the order of magnitude development must be separated cost-wise from each

of a return on an expenditure to gain savings in labor other. Each company has reason and need for various

and/or material costs. The nomograph is used to deter- arrangements in order to present proper information for

mine the investment justified by a gross annual savings, tax purposes and depreciation. Although the project engi-

assuming a percent return, a percent annual depreciation neer is usually responsible for this phase of coordination

charge, and a 50 percent Federal tax on net savings. through the engineering groups, it is often necessary that

0 25

5,000 20

l0,OOJ .

r- e

-s

t .E

4->

wo

v)

15,000

20,000

Figure 1-40. Annual saving, return, and depreciation of

fixed adjustable investment. By permission, G. A. Lar-

25,OOC

1 son [6].