Page 54 - Budgeting for Managers

P. 54

The Parts of a Budget

four most important standard accounting reports: the balance

sheet, the income and expense statement, the cash flow state-

ment, and the accounts receivable statement.

Right now, let’s look at two reports you can get from the

accounting department that can be really useful: the expense 37

(or income and expense) statement tracking estimated vs. actu-

al and the accounts receivable report, which will show you how

quickly you are getting paid by your customers.

Tracking Expenses: Estimated vs. Actual

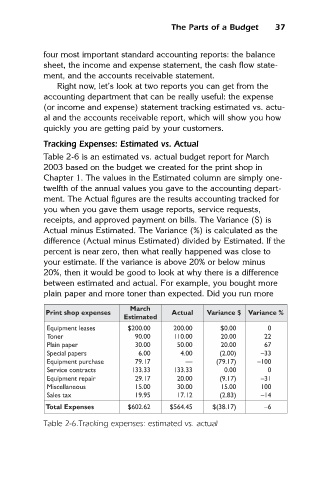

Table 2-6 is an estimated vs. actual budget report for March

2003 based on the budget we created for the print shop in

Chapter 1. The values in the Estimated column are simply one-

twelfth of the annual values you gave to the accounting depart-

ment. The Actual figures are the results accounting tracked for

you when you gave them usage reports, service requests,

receipts, and approved payment on bills. The Variance ($) is

Actual minus Estimated. The Variance (%) is calculated as the

difference (Actual minus Estimated) divided by Estimated. If the

percent is near zero, then what really happened was close to

your estimate. If the variance is above 20% or below minus

20%, then it would be good to look at why there is a difference

between estimated and actual. For example, you bought more

plain paper and more toner than expected. Did you run more

March

Print shop expenses Actual Variance $ Variance %

Estimated

Equipment leases $200.00 200.00 $0.00 0

Toner 90.00 110.00 20.00 22

Plain paper 30.00 50.00 20.00 67

Special papers 6.00 4.00 (2.00) –33

Equipment purchase 79.17 — (79.17) –100

Service contracts 133.33 133.33 0.00 0

Equipment repair 29.17 20.00 (9.17) –31

Miscellaneous 15.00 30.00 15.00 100

Sales tax 19.95 17.12 (2.83) –14

Total Expenses $602.62 $564.45 $(38.17) –6

Table 2-6.Tracking expenses: estimated vs. actual