Page 79 - Design for Environment A Guide to Sustainable Product Development

P. 79

58 Cha pte r F o u r

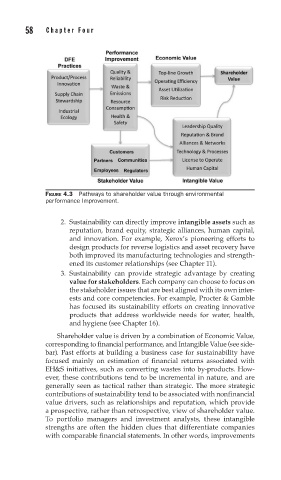

FIGURE 4.3 Pathways to shareholder value through environmental

performance Improvement.

2. Sustainability can directly improve intangible assets such as

reputation, brand equity, strategic alliances, human capital,

and innovation. For example, Xerox’s pioneering efforts to

design products for reverse logistics and asset recovery have

both improved its manufacturing technologies and strength-

ened its customer relationships (see Chapter 11).

3. Sustainability can provide strategic advantage by creating

value for stakeholders. Each company can choose to focus on

the stakeholder issues that are best aligned with its own inter-

ests and core competencies. For example, Procter & Gamble

has focused its sustainability efforts on creating innovative

products that address worldwide needs for water, health,

and hygiene (see Chapter 16).

Shareholder value is driven by a combination of Economic Value,

corresponding to financial performance, and Intangible Value (see side-

bar). Past efforts at building a business case for sustainability have

focused mainly on estimation of financial returns associated with

EH&S initiatives, such as converting wastes into by-products. How-

ever, these contributions tend to be incremental in nature, and are

generally seen as tactical rather than strategic. The more strategic

contributions of sustainability tend to be associated with nonfinancial

value drivers, such as relationships and reputation, which provide

a prospective, rather than retrospective, view of shareholder value.

To portfolio managers and investment analysts, these intangible

strengths are often the hidden clues that differentiate companies

with com par able financial statements. In other words, improvements