Page 234 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 234

216 Dubai & Co.

made sense for GCC economies considering their dollar-denomi-

nated exports, the situation is changing: inflationary pressures, a

slipping dollar, and the increasing importance of Europe as an

import source are causing Gulf states to rethink the peg. In May

2007, Kuwait announced it would end its dollar peg, to reduce what

5

analysts dubbed “imported inflation.” Other states may follow

suit, though Saudi Arabia—the biggest GCC economy of all—

appears unlikely to budge in the near term.

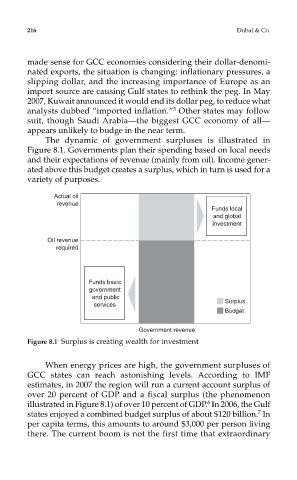

The dynamic of government surpluses is illustrated in

Figure 8.1. Governments plan their spending based on local needs

and their expectations of revenue (mainly from oil). Income gener-

ated above this budget creates a surplus, which in turn is used for a

variety of purposes.

Figure 8.1 Surplus is creating wealth for investment

When energy prices are high, the government surpluses of

GCC states can reach astonishing levels. According to IMF

estimates, in 2007 the region will run a current account surplus of

over 20 percent of GDP and a fiscal surplus (the phenomenon

6

illustrated in Figure 8.1) of over 10 percent of GDP. In 2006, the Gulf

7

states enjoyed a combined budget surplus of about $120 billion. In

per capita terms, this amounts to around $3,000 per person living

there. The current boom is not the first time that extraordinary